Bitcoin: Is crypto winter coming now?

In the downward phases after a cyclical high, bitcoin typically loses more than 80 percent of its value. Has such a phase already started again now?

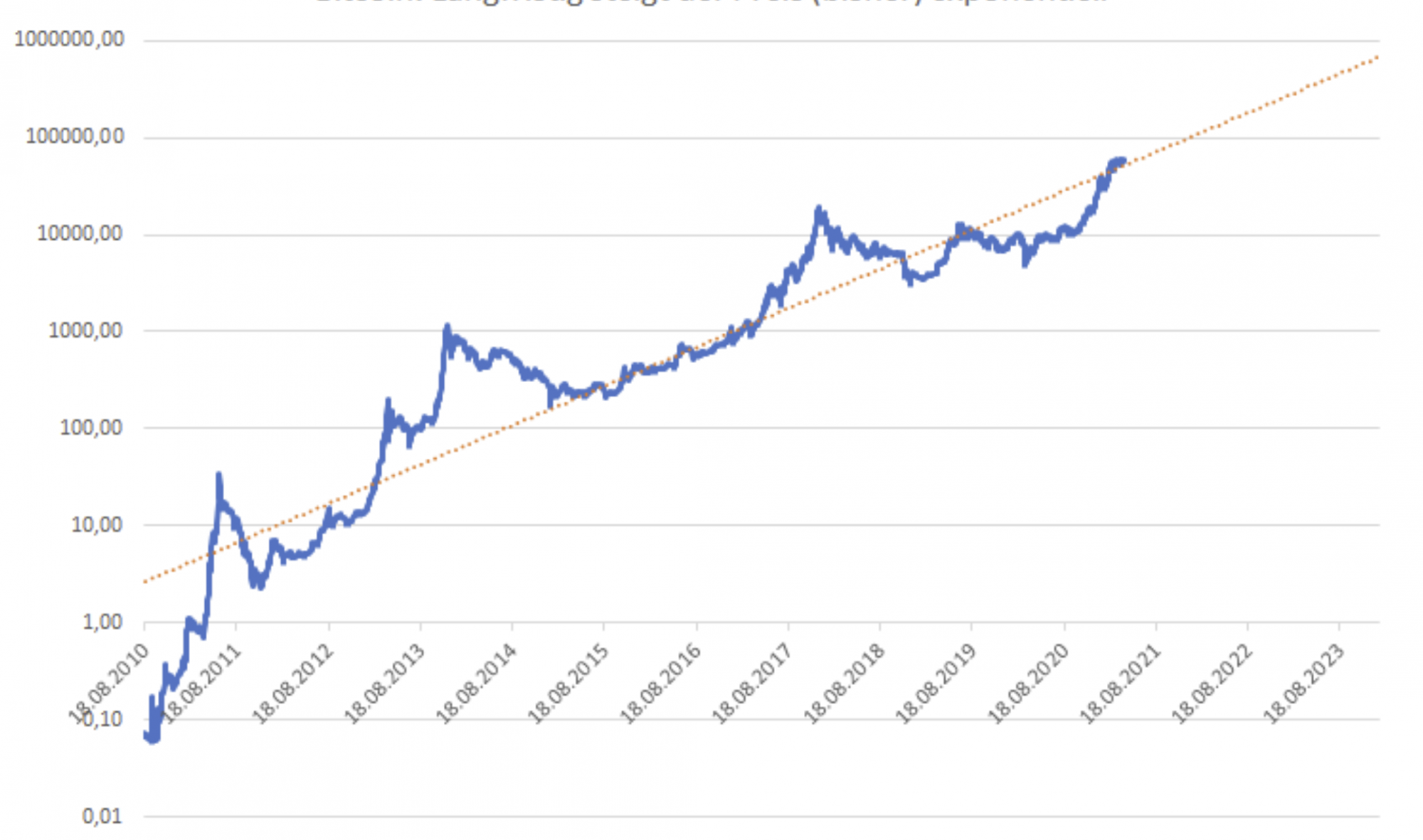

If you look at the long-term price development of the Bitcoin, you can notice two things in particular:

- In a very long-term view, the price of Bitcoin has so far shown exponential growth in a good approximation.

- At the same time, the price development follows a clearly pronounced cycle with a period duration of about four years, in which a new cycle high is regularly reached about one to 1.5 years after a so-called Bitcoin halving (in which the yield of the Bitcoin miners is halved).

The following chart shows the long-term exponential performance of Bitcoin. Note the logarithmic plot of the y-axis. In such a (semi-)logarithmic chart, the exponential growth corresponds to a straight line in the chart. As you can see, the Bitcoin follows the model of an exponential price development quite well so far, despite the high volatility.

In a strongly logarithmic chart, however, price fluctuations are visually much less noticeable than in a linear chart. Somewhat casually, one could say: If the price in the above chart does not increase tenfold or tenfold, the development is hardly noticeable.

In order to show the strongly cyclical development of the bitcoin price at the same time, the following chart exclusively shows striking high and low points of the price development. It should be noted that only daily closing prices were taken into account when creating the chart (intraday there were higher highs and lower lows) and that especially at the extreme points there are often larger discrepancies between different trading centers.

The chart shows that on average a new cycle high occurs about 15 months after a bitcoin halving. Between bitcoin halving and a new cycle high, prices rise particularly strongly (more strongly than in any other phase). In recent months, we have been in such a phase, as the last bitcoin halving occurred on May 11, 2020, a little less than a year ago. So the strong price gains in the past few months did not come as a surprise, but followed very well the pattern known from previous cycles.

The chart also shows that the current cycle high should not be long in coming or could even be behind us already. The shortest time span so far between bitcoin halving and a new cycle high was only a little more than a year. This period of time has already almost elapsed. It is also by no means impossible that the current cycle is somewhat shorter than the previous ones and that the current cycle high is therefore already behind us! In this case, the new crypto winter would therefore have already begun. In the downward phases after a cyclical high, bitcoin typically loses more than 80 percent of its value in about a year.

DepthTrade Outlook

If the development known from previous cycles continues, bitcoin should reach the high in the current cycle in the coming months and then fall back again significantly. In the process, it could well come to strongly rising prices once again, since explosive price increases typically occur directly before the cycle high. However, it cannot be ruled out that the almost $65,000 reached in mid-April already marks the high in the current cycle. In this case, crypto investors would have to prepare for sharply falling prices in the coming months. The crypto winter would then have already started again and price losses of 80 percent and more compared to the most recent high would have to be planned for.