Why is the Japanese Yen ‘crashing’?

Within the past month, the U.S. dollar strengthened and the yen weakened heavily, with USD/JPY hitting the 125-yen level at one point (see chart below). Not only the U.S. dollar/yen but also other yen pairs, such as the euro/yen (EUR/JPY) and the Australian dollar/yen (AUD/JPY), rose sharply, in other words, the yen weakened across the board. In this issue, I would like to consider why the yen has weakened across all other major currencies and what the future holds.

One of the reasons why the yen has weakened so extensively in the euro/yen and Australian dollar/yen crosses is probably due in large part to technical factors. For nearly a year, most of the yen crosses have been trading in a narrow range of 5-7%, such as 128-134 yen to the euro and 79-85 yen to the Australian dollar, with little sense of direction.

When a long-lasting range is broken, the accumulated energy tends to dissipate and move in one direction in a big way, and the current single-step depreciation of the yen against the cross-currency may be the result of such a mechanism.

Looking at the relationship with interest rate differentials, the yen’s inferiority in terms of interest rate differentials has already expanded significantly for many cross currency pairs since the beginning of 2022. However, until now, the reaction of the yen against the cross-currency has been sluggish. This may have been due to the fact that, as a result of the strong influence of U.S. dollar trading amid the concentration of interest in U.S. monetary policy, it was difficult to get directional movements in foreign currencies other than the U.S. dollar against the yen.

It could be said that the long-standing small moves in many of the currency pairs broke in the direction of yen depreciation over the past month and that the sharp expansion of yen depreciation was a move to correct the relationship with the interest rate differentials, which had been widening.

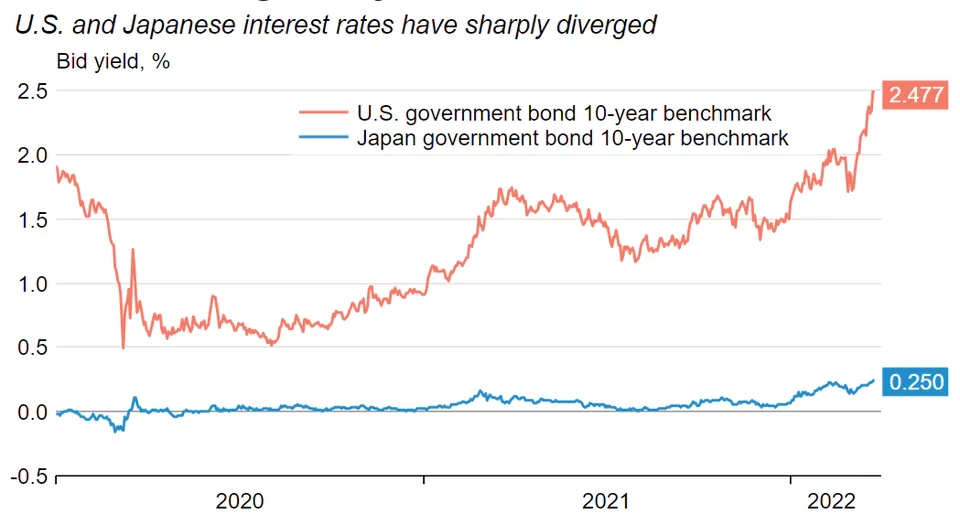

By the way, the interest rate differentials have recently accelerated in a direction that suggests a weaker yen. This was probably due in large part to the BOJ confirming its policy of not tolerating excessive increases in interest rates since February amid the global rise in interest rates.

Long-term interest rates and 10-year Treasury yields in the U.S. and Japan have basically been moving in roughly overlapping directions. Recently, however, there has been a noticeable difference between the pace of interest rate hikes in the U.S. and in Japan.

In this context, the widening of the interest rate differential between Japan and the U.S. and other countries has accelerated, to which the yen has finally responded by depreciating in one step.

Some have suggested that the general depreciation of the yen could be the beginning of a flight of capital from Japan, but I don’t think that’s the case at the moment. In the last week, as we have seen so far, the general depreciation of the yen has spread, but at the same time, stock prices around the world have risen significantly, and Japanese stocks have also seen a noticeable upswing.

What has been interesting in the context of equity prices has been the extremely limited response of the yen to the temporary global equity market weakness that unfolded in March. In the past, when equity prices fell and risk appetite increased, the yen tended to appreciate as it was bought as a safe haven, but this relationship has clearly dissipated recently.

Weakness in the stock markets and risk mitigation have been important factors in the yen’s appreciation. However, confirmation that the yen will not strengthen even with weak stock prices has led to a positive trend toward a weaker yen, including an increase in interest rate differentials, and the yen has depreciated not only against the U.S. dollar but also against currencies other than the U.S. dollar.

Nevertheless, if the situation persists where yen appreciation is limited even with weak stocks, the risks of a stronger yen will be limited to a sharp rise in yen interest rates, and it seems likely that the risks of a relatively weak yen will continue.

DepthTrade Outlook

- From a technical perspective, it is likely that most currency pairs will continue to trend towards a weaker yen, with limited consolidations.

- Fundamentally: Bank of Japan Governor Haruhiko Kuroda has made it clear that a weak yen is in the BoJ’s interest.