Never before has a country been sanctioned as heavily and comprehensively as Russia. It is an experiment to see whether it is possible to end a war with financial and economic measures. If successful, it would be a valuable signal to the world community. Conversely, trade and economic wars are then likely to intensify further.

In light of this, the freezing of Russia’s foreign currency reserves at foreign central banks and credit institutions must be viewed with concern. Ultimately, this will threaten the Russian state with insolvency because repayments and interest on bonds can no longer be paid.

Unlike, for example, the Argentinean state bankruptcy, Russia is not overindebted or has no more assets, but the Russian state – which is also rich by international standards – can no longer access its assets. It is therefore not a state bankruptcy “for lack of assets,” but for lack of availability.

Of course, this prevents Russia from buying more weapons through contracts with states that do not support the sanctions. However, the step of freezing state assets also harms all those who have provided Russia with money. These were not only Russian oligarchs but also international banks and capital collection agencies.

Thus, quite a few investors in fund products of large providers will also have admixtures of Russian government bonds, for which there is currently no real price-fixing and for which there is a repayment risk.

This collateral damage, too, can or must perhaps be accepted in order to stop a war. However, much more is happening. The freezing of Russia’s foreign currency reserves is a very dangerous instrument. It can bring creditworthy states to their knees because they can no longer access their assets stored abroad.

Now, this may be justified. But if this policy had already been tested and perhaps even accepted in the U.S. when Donald Trump was in office, for example, the then U.S. president might have frozen Mexican state assets held in the United States. This could also have been a measure towards China, especially since the step of freezing foreign assets is not far from not repaying debts.

Bonds are loans granted to states, institutions, and companies. The lender believes in the debtor’s ability and willingness to pay. If this trust is lost, it becomes difficult on the capital markets. The euro debt crisis has shown this. The instrument used against Russia goes even further: Here, the debtor’s ability to pay is taken away by the location of the assets. It raises the instrument of an asset attachment to a completely different level.

But the capital markets are based on trust, which is lost if the rules are not observed. In the short term, therefore, it may be a success and lead Russia into state bankruptcy not through over-indebtedness but through lack of access, but in the long term, this policy is quite dangerous. In order to achieve a higher goal, Western states, in particular, intervene deeply in the property rights of a third party. It is to be hoped that this will not become a common instrument to enforce interests – no matter how well-intentioned they may be.

DepthTrade Outlook

These developments are interesting for investors on two levels. First, insolvency is being redefined to some extent. It no longer has to arise because there is no asset substance but results here from non-availability. This has then also been artificially brought about, which must lead to a redefinition of liquidity and fungibility from the investor’s point of view.

Bonds must therefore now not only be defined from the perspective of “safe, substantial and profitable,” but must also be viewed more from the perspective of overriding moral value. If this is not sufficiently given, there is a risk that there will be repayment difficulties.

The second level, however, is also the question of the storage of investments selected under these criteria. Up to now, it has been the case that there is always a right of segregation for all forms of listed securities, irrespective of the creditworthiness of a credit institution.

As is currently the case with Russia’s foreign exchange reserves, this right of segregation can also be undermined. In this case, an investor may have excellent assets in his possession, yet they are not available to him. Therefore, in addition to the investments themselves, in the future, the depositories, such as custodian banks and credit institutions, must be selected in such a way that they comply with a “moral values compass”.

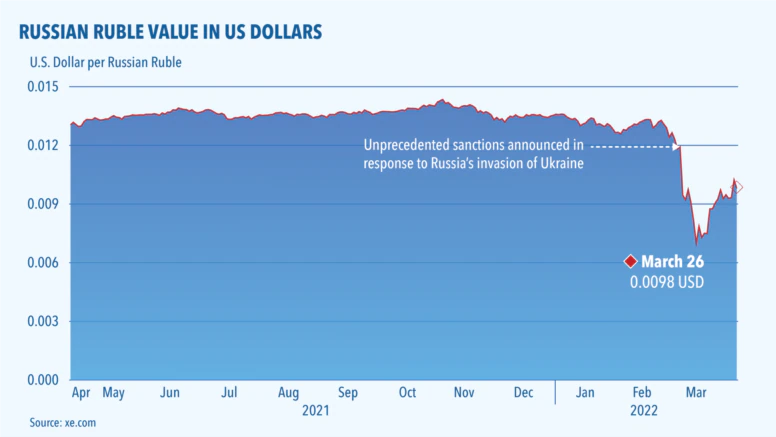

The Russian Ruble

Medium and long-term bearish. From strong inflation to hyperinflation, anything is now possible. For Forex speculators a unique opportunity, however, some brokers now no longer allow shorts on rubles. I would recommend the currency pairs CHF/RUB and USD/RUB.