Recent developments in the field of geopolitics have made even die-hard bulls in the financial markets cautious in the meantime. A world that was already facing significant growth risks, including a looming slowdown in growth, before the outbreak of war in Ukraine will now have to tighten its belt once again in all places.

Even without the Russian invasion of Ukraine, the signs of a change of course, including far-reaching adjustments and changes in the political and monetary policy strategies pursued up to this point, became more pronounced.

Geopolitical risks can hardly be assessed anymore

A massive increase in uncertainty and a veritable explosion of risks in the geopolitical arena is now threatening to throw previously envisaged changes in strategy completely out of kilter.

The major U.S. bank Goldman Sachs is complaining these days that the development opportunities arising from the current situation are not only very diverse but also hardly foreseeable.

Of course, this outlook also affects portfolio management as such, while the difficulties and problems in the field of money management increase with each passing day.

Although some of these risks and dangers existed even before the outbreak of war in Ukraine and the imposition of Western sanctions on the Russian Federation, the mess that has now emerged highlights further dangers that most players in the financial markets have never had to deal with up to this point.

An enormously increasing volatility

On the one hand, an enormously increasing volatility would be at the center of these considerations. On the other hand, the main issue at the moment is how to address existing portfolio risks and bring them under control.

At the beginning of last week, not only had the market capitalization on the U.S. stock exchanges been reduced by another trillion U.S. dollars, but on the surface, the process of de-leveraging (a reduction in debt and leverage) among large and institutional investors was continuing.

U.S. stock markets were still holding up quite nicely in the face of Brent oil prices remaining above the $100 mark, inflation in the U.S. continuing to rise to 7.9 percent in February, and Russian military forces invading Ukraine in the meantime.

Indices do not reflect the damage done at the individual level

However, the major stock indices in the U.S. no longer even begin to reflect the damage already done at the individual stock level – and this despite the ludicrous level at which real interest rates in the U.S. continue to be, as Goldman Sachs finds.

At the same time, there is no way of knowing what the knock-on effects and feedback effects will be from the perspective of the global economy if a G20 economy were to be excluded from the world financial system.

In the course of the next few months, economic developments in the United States would again come to the fore to a far greater extent than in recent weeks and months.

Development of the U.S. Yield Curve

It should be noted that the course of the yield curve in the United States does not bode well, as an inversion is already discernible in some areas and the entire curve is likely to follow soon.

Over the course of the past decades, an inverted yield curve in the U.S.A. – with rare exceptions – had proven to be a reliable indicator of the onset of an impending recession.

Current incoming economic data from the United States also point to this. In addition to consumer confidence, which is completely in the cellar, the purchasing managers’ indices have recently also pointed to an accelerating downturn in the country.

Yesterday’s data on consumer spending was also not good, which is likely to contribute to the fact that the growth model used by the Fed of Atlanta, called GDPNow, should soon indicate an economic contraction in the U.S. in the first quarter of this year.

Federal Reserve

Of all things, raising its own key interest rate into such a situation – as happened yesterday for the first time since 2018 – suggests not only that the Federal Reserve is lagging behind what’s happening in its home market, but that the Fed appears to be so far behind the curve yet again as to raise its own key interest rate into a looming recession.

Yesterday, the Fed indicated that it intends to raise its own key interest rate further at all interest rate meetings still to be held in the current year. Based on this, it would still be possible to derive a potential of an additional six interest rate hikes in 2022.

Who is still surprised that the expectations at the interest markets after these statements made yesterday by Fed chief Jerome Powell have turned now into the exact opposite, in order to assume meanwhile already again from beginning interest cuts in the year 2023?!

Finally, the Federal Reserve of one in view of the particularly pursued monetary policy with a caused economic downswing in the USA will have to align itself probably already in foreseeable time differently, in order to earn itself in the recession fight.

It will probably be precisely this outlook that once again fueled the oil, precious metals, and commodities markets yesterday, as it is now clear that the Federal Reserve and other major central banks have degraded themselves to paper tigers over the past few years.

Stagflation increasingly likely

Stagflation (economic stagnation + inflation) remains the buzzword of the day. As expected, central banks now find themselves in a situation in which those responsible for them are confronted with mutually contradictory developments in the economy – very likely without being able to provide an adequate response.

As far as Goldman Sachs is concerned, the current situation is described there as follows: It gives the impression that in recent weeks additional gasoline has been poured on the burning fire of changes of tectonic proportions that are already underway.

Globalization has been dealt a severe blow. Suddenly, buzzwords like regionalization were doing the rounds again. The era that began with the fall of the Berlin Wall in 1989 and ended in 2016 with the United Kingdom’s withdrawal from the European Union will now be followed by something else.

The geopolitical tensions between the West and the East could hardly be greater, which points to a dramatic change regarding the global order. In particular, a growing rift is becoming apparent between the Western industrialized countries and the so-called BRICS states.

Global Financial Markets in the Conflict between East and West

This development will not remain without consequences on the global financial markets. On the contrary, a further increase in volatility is to be expected in many areas, which would be very difficult for traders to assess and evaluate.

This means that the continuing roller coaster rides of prices on the financial markets could catch many market players on the wrong foot. In this way, there is also a risk of an increase in the degree of fragility on the international financial markets – and an accelerating decline in liquidity.

Yesterday’s developments in the People’s Republic of China are probably a very good synonym for this. After Chinese technology shares had recently collapsed to price levels from the years of the Lehman bankruptcy, the Beijing government probably felt compelled to intervene, at least verbally.

In the course of this, the Chinese government promised to provide more support to the domestic financial markets, which was enough to catapult completely bombed-out prices by forty percent within just one trading day.

Of course, after a previous slump of 75 percent, China equities still have an ultra-long way to go if these price losses are to be recovered. However, it should not be forgotten that the Beijing government will now also have to deliver, which would involve a departure from previously pursued strategies.

On the other hand, it should be remembered that in bear markets there can always be sudden and massive price rallies to the upside. Something like this could be observed yesterday in the People’s Republic of China.

At Goldman Sachs, such a view is shared. This shows how difficult such a market is to trade if one also takes into account that the major American bank JPMorgan had just two days earlier described Chinese technology stocks as a sector that had become “uninvestable“.

A whole lot of short-sellers who got carried away are likely to have taken a huge hit in the face of the rally on the Chinese technology markets that began yesterday in the course of an enormous short squeeze. I wonder if JPMorgan may have been among those players?

Goldman Sachs believes that commodities will play a more significant role

At Goldman Sachs, attention was also drawn to the price rally in the commodities sector, which has not been seen since the 1970s and which, particularly in the last two months, has almost rolled over everything like a steamroller.

Similar to Zoltan Pozsar from the Credit Suisse Group bank, Goldman Sachs also assumes that commodities will play a far more important role in the future than in the recent past.

DepthTrade Outlook

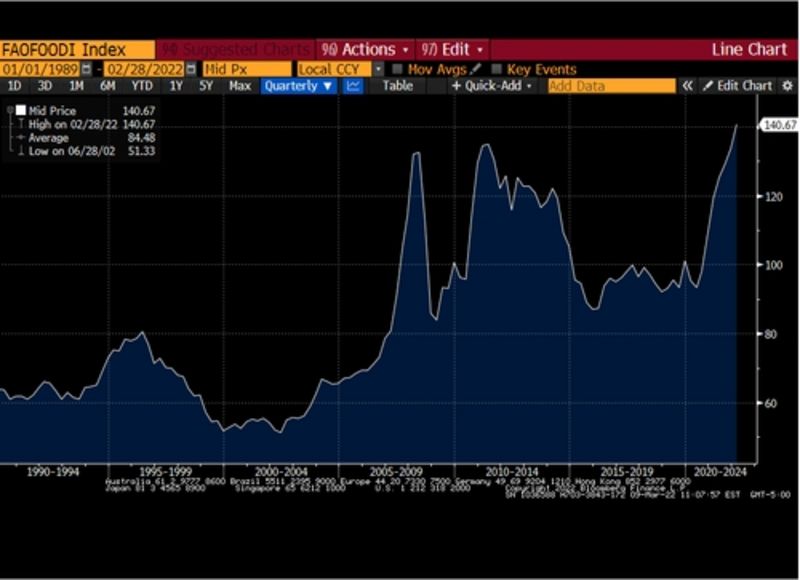

Finally, I would like to draw your attention to a chart showing the development of food and agricultural commodity prices calculated by the United Nations. This alone shows that the globe is facing a similar – or perhaps even worse – crisis than in 2011.

At that time, the so-called Arab Spring occurred in a large number of nations, in the course of which governments were also overthrown, as in the case of Tunisia, for example. With talk of supply shortages, product failures, and increasing shortages everywhere, this development should be given due respect.