CoT Report – Big Players Continue to Accumulate

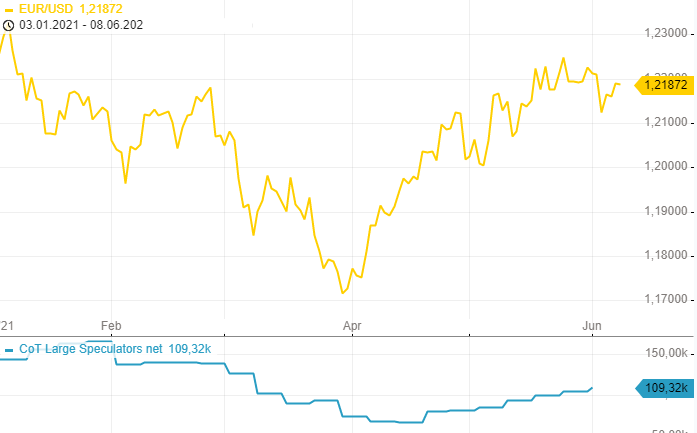

Large speculators continue to bet on a positive development in the EUR/USD exchange pair, according to the latest CoT Report.

Purpose of the CoT Report

The CoT Report refers to the trading positions of notifiable market participants in futures transactions. The aim is to create transparency about the positions in the form of a list of the open interest, i.e. all open futures and options contracts. Every Friday, the positions that exist on Tuesday evening after the close of trading are published. Traders can anticipate statements about the “positioning” of large market participants. (in detail: here)

The most important changes among the large speculators in the past week

According to the latest data, the net long position of the large speculators in the EUR future was again marginally increased, and the total position of the large speculators thus currently amounts to a good 109,000 contracts net long, according to the latest data. Thus, the trend of the past weeks continues – the large speculators tend to further increase their EUR long positions. The pair itself has been consolidating around the 1.22 mark for several trading days and is not making any further progress. However, new buy signals would emerge here above USD 1.2215.

For the Canadian dollar, the net long position of the large speculators was kept fairly constant at just under 49,000 contracts net long, according to the latest data.

Commodity currencies remain strong, however, the USD/CAD bulls have been able to successfully defend the psychologically important 1.20 level for several weeks.

In the GBP future, the existing net long position was reduced by almost 5,000 contracts according to the latest data. After a new movement high in the previous week, Cable is currently consolidating in a narrow range below the 1.42 mark.