Escalating Global Supply Chain & Energy Crisis

Supply problems now exist in almost every major sector of the global economy due to the ongoing shipping, container, and transportation crisis. Energy prices that are literally shooting through the roof are only complicating the looming interplay of multiple trouble spots. The government-imposed lockdowns unfold their delayed effect.

Last week, the largest aluminum metal producer in the USA also warned that there would be a drop in production into 2022 due to a shortage of magnesium at the company.

From the point of view of the automobile and construction industries in particular, this announcement is proving to be anything but a good omen, as these sectors have already been experiencing shortages of intermediate products such as semiconductors and electronic chips as well as wood for many months.

Companies warn of standstill – and hoard what they can find

As Tom Horter, president of the Matalco company warned in this context, there has been a near halt in magnesium supplies over the past few weeks.

For this reason, his company has not yet been able to stock up on all the magnesium required for the 2022 production year. From his company’s point of view, it is becoming increasingly difficult to stock up on important precursors on the raw material markets.

In addition, global energy prices are rising, further exacerbating the current problems. The basis of the warning now issued is to make financial market players aware that Matalco’s production could be significantly affected in 2022 if the group does not manage to stock up on a sufficient quantity of important precursors.

If this is indeed the case, Matalco’s customers must also be aware that their orders can only be partially fulfilled. Matalco is currently in the process of securing as much silicon, magnesium, and other important primary products and raw materials as possible in order to keep its own production stable.

Without a sufficient amount of magnesium, it would not be possible to produce aluminum compounds, which are urgently needed in the automotive industry for the manufacture of vehicle frames, engine blocks, and other important components.

Largest producer China restricts production

By contrast, the latest reports coming in from the People’s Republic of China, the world’s largest producer of magnesium, regarding the mining of this important raw material there proved anything but encouraging when the current situation is taken into account.

Due to electricity problems, China plans to significantly limit the production of magnesium in the coming months. However, the element is essential for the metal industry in Europe. Around 90 percent of global production comes from the giant country, with only Russia, Kazakhstan, and Israel still holding market shares of a few percent.

Europe, which buys 95% of its magnesium from China, is expected to run out of the metal by the end of November, a group of industry associations said.

Not only the European metal and automotive industry will suffer massively from this development, but competitors all over the world are likely to face major difficulties if the prevailing situation does not improve soon.

Alcoa also warns – impact on automotive industry foreseeable

Significant increases in energy prices, a widening shortage of skilled labor, and a continuing crisis in the shipping container and transport markets also put an increasing number of intermediate product suppliers under massive pressure.

Similar to the case of Matalco, the American aluminum producer Alcoa also recently warned of increasing shortages in the silicon and magnesium sectors. Should both Matalco and Alcoa have to significantly reduce their production of aluminum compounds due to the shortage, it is easy to imagine what the consequences and effects of such a development would be from the perspective of the automotive industry.

Bauxite: Military coup in Guinea & global electricity prices – aluminum price skyrockets

Concerns among analysts and commentators on the financial markets were recently added to by the developments observed in the African country of Guinea. There, a military coup against the government took place in September, leading to speculation and worries about a possible shortage of supply in the bauxite sector.

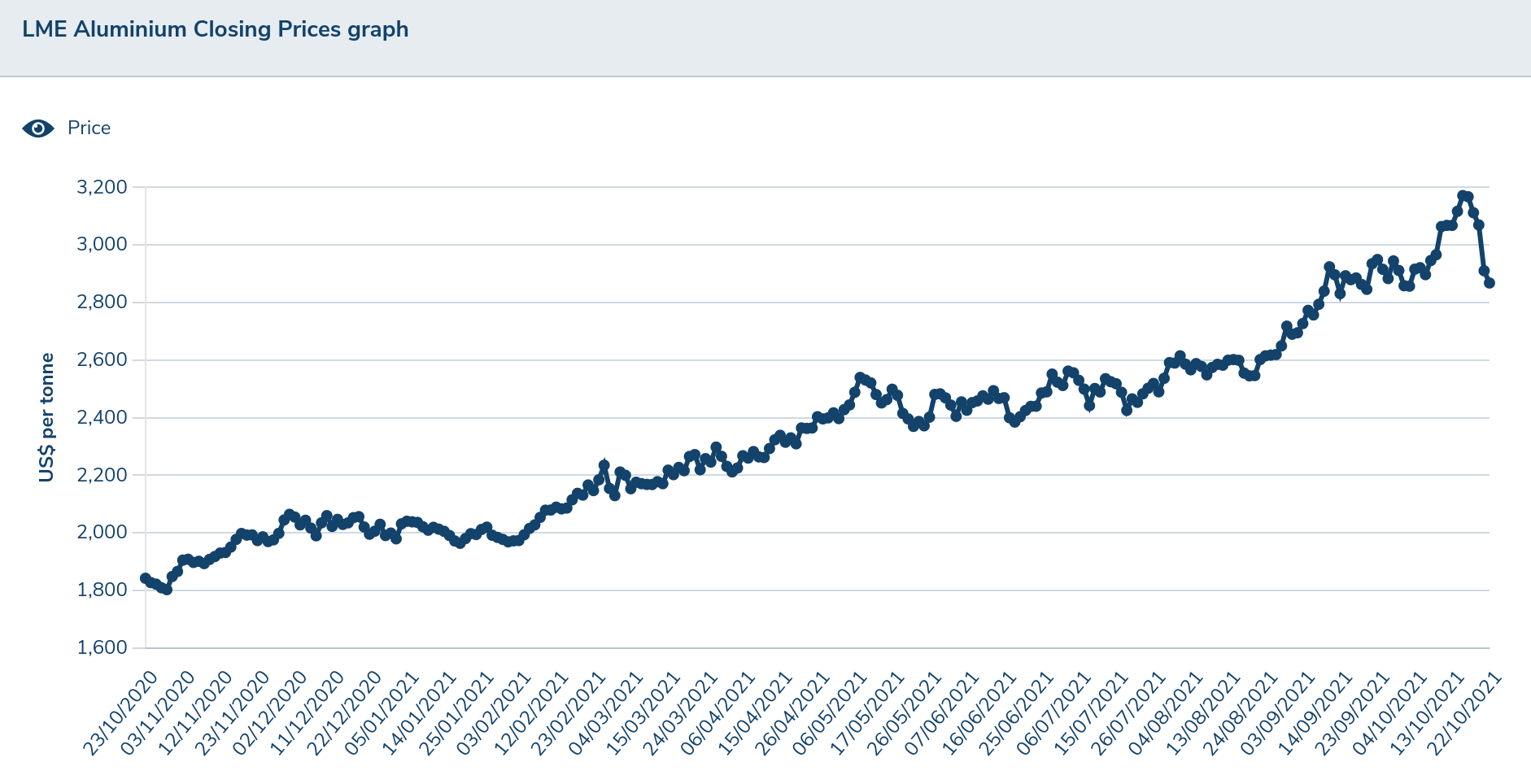

Bauxite is a sedimentary rock that is very rich in aluminum. In view of a temporary closure of aluminum smelters on the Asian and European continent due to a currently too high demand for electricity, the aluminum price on the London Metal Exchange (LME) has literally shot through the roof, rising to a new all-time high in the process.

It is now almost a foregone conclusion among analysts and other observers that the partly massive price increases on the commodity markets will further boost general inflation in the broad economy.

To what extent the narrative spread by Fed Chairman Jerome Powell and other usual suspects with regard to a merely “temporary” and evaporating rise in inflation fits into the currently observable circumstances is a question I would like to leave to each reader to answer for himself.

Supply chain crisis threatens to worsen – product shortages widening

As winter approaches in the northern hemisphere, the global supply chain crisis threatens to intensify in a significant way. In some areas, even in the food sector, there are already chronic shortages and spreading product shortages in the UK or even the USA.

Perhaps the current developments, which can be observed worldwide, only show the results of an over-centralization of our countries.

On the page of The Atlantic, it was recently even said that, following the concept of the Everything Bubble in the United States of America, an Everything Shortage has meanwhile also occurred.

Some commentators now refer to Murphy’s Law, which states that anything that can go wrong after a certain point will go wrong.

Lockdowns as the cause – virus as a practical scapegoat

It is becoming increasingly clear these days that corona lockdowns imposed by governments around the globe have led to serious supply chain problems along with increasingly vulnerable production.

Not only does the People’s Republic of China continue to experience significant shipping congestion at the country’s major seaports, but the same situation is also prevalent at seaports on the U.S. West Coast.

A freight container that may have cost 2,500 US dollars before the outbreak of the Corona crisis now goes for up to ten times that price (!), i.e. for up to 25,000 US dollars.

It goes without saying that these immense cost increases will at some point have to be passed on by the companies affected by them to their customers – and thus to consumers – to avoid the risk of margins plummeting and losses being reported.

From the point of view of the ruling class, however, these developments also prove to be a welcome explanation for blaming almost everything that was already going wrong in the world economy before the outbreak of the Corona crisis entirely on the sudden appearance of this virus.

Furthermore, if a critical and widening shortage of workers in the U.S. airline industry were to occur due to vaccination mandates, resulting in multiple bankruptcies among airlines, U.S. Freedom Flyers spokesman Yoshua Yoder warned that US supply chains could fully collapse.