Famous Investors warn of the “Biggest Crash in History”

Two prominent investors are independently sounding the alarm: Jeremy Grantham and Michael Burry believe the financial markets are on the verge of the biggest crash in history. Especially in meme stocks and cryptocurrencies, both fear catastrophic losses.

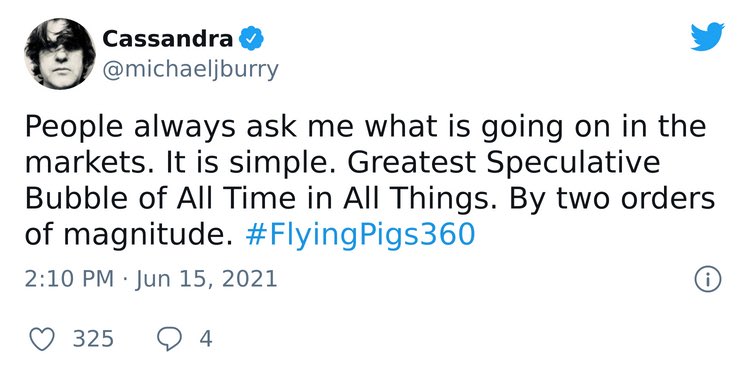

Michael Burry had already warned on June 16 of the “biggest speculative bubble ever in all things”

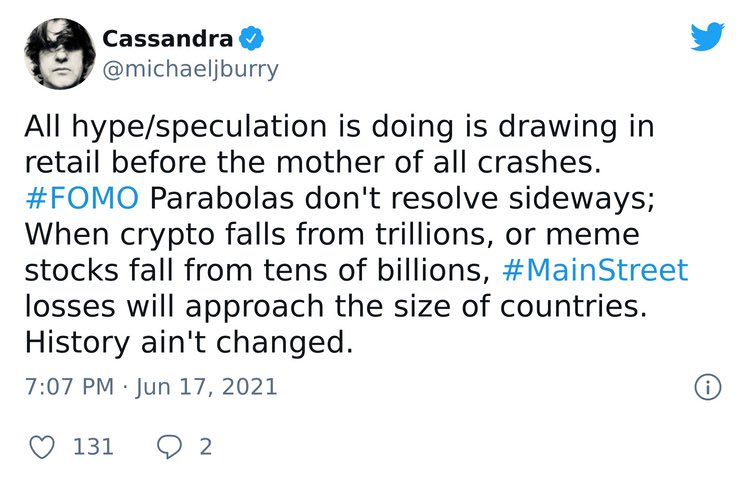

The following day, Burry followed up. In a tweet that has since been deleted, Burry wrote:

Michael Burry became famous primarily for his successful bets on the collapse of the U.S. real estate market in connection with the 2008 financial crisis. In the movie “The Big Short,” the somewhat cranky portfolio manager was played by Christian Bale. Burry sees himself as a classic value investor and has long considered valuations in the financial markets to be completely exaggerated.

Value investor Jeremy Grantham, who warned in January of a crash of a similar magnitude to that of 1929 or 2000, is taking a similar line to Burry.

In a longer interview with Bloomberg, Grantham now said that the past 12 months would represent the “classic finale of an 11-year bull market.” Measured by the price-to-sales ratio, the overvaluation is even greater now than it was at the peak of the Internet bubble during the turn of the millennium, Grantham said.

High trading volumes in call options and penny stocks are also typical signs of a bubble, he said, as are debt and margin loans at record levels.

“Having checked all the necessary boxes of a speculative peak, the U.S. market has historically been entitled to collapse since January,” Grantham said.

What’s particularly dangerous about the current bubble, he said, is that with the stock, bond and real estate markets all overvalued at the same time and now commodity prices surging as well. There has never been anything like this before, Grantham said. The most similar, he said, was the speculative bubble in Japan in 1989. To date, neither land prices nor stock prices in Japan have recovered to 1989 levels, Grantham said.

Grantham was particularly pessimistic about cryptocurrencies and meme stocks. Gambling with meme stocks “just because it’s funny” has become “commonplace,” Grantham said. “It’s a completely nihilistic parody of actual investing. This is it, guys, the greatest U.S. fantasy trip of all time.”

DepthTrade Outlook

It remains to be seen whether Burry’s and Grantham’s warnings may come to pass, or whether both will simply join the long line of crash prophets who have been expecting a crash for many years in view of fundamentally high valuations, but whose forecasts to date have had nothing whatsoever to do with reality. In any case, in view of low and negative interest rates, the markets do not seem to have any problem with what at first sight appear to be high valuations.