It’s not just gasoline and diesel prices that are literally shooting through the roof in the United States at the moment, climbing to new record highs almost every day. The global supply situation also remains extremely tight due to a number of interacting factors. This report takes a closer look at the energy, gasoline, and diesel markets – following warnings of a potential total diesel supply shortage on the U.S. East Coast.

The International Energy Agency (IEA) has published its monthly energy market report, which is accompanied by a not particularly positive outlook. First and foremost, this applies from the perspective of the United States of America.

According to the IEA’s new monthly report, the situation in the global crude oil markets will not ease in the coming months. On the contrary, the supply situation is expected to remain very tight.

Oil stocks are at historically low levels in many places

On the one hand, an informal oil import embargo imposed by the West on Russia is blamed for this. On the other hand, oil inventories in many nations are at historically low levels.

At the same time, the IEA forecasts that global demand for distillates such as diesel and gasoline will remain high, while the crude oil needed to produce these distillates will not be able to keep up with this demand in terms of supply.

The current situation in the international energy markets is described by the IEA as the calm before a storm breaks. Despite growing international pressure and a simultaneous decline in crude oil production, the Russian Federation has so far managed to maintain its own oil exports at a high level.

However, the expiration of an ultimatum issued by the European Union to major commodity trading houses, which are required by Brussels to abandon their business relations with Russian oil and gas companies such as Gazprom and Rosneft as of this date, has recently become apparent.

Russia’s oil production falls – despite everything, the Kremlin’s revenue/energy profit rises

According to the IEA report, oil production in the Russian Federation fell by just over one million barrels per day in the month of April. By the end of this year, this figure could reach about three million barrels per day. Nevertheless, the Russian Ministry of Finance is currently enjoying record revenues from the energy business.

At the same time as crude oil output in Russia is tending to fall further, prices on the international energy markets – especially in the crude oil and gas sectors – have literally shot through the roof in recent weeks and months.

According to the IEA, scarcely available storage capacities in the refinery sector and declining crude oil, gasoline, and diesel exports from the Russian Federation are the main factors contributing to a persistently tight supply situation in the global energy markets.

Even a renewed release of parts of the strategic petroleum reserves in the U.S. has so far not changed this situation, because so far nothing of this can be observed in the distillates such as gasoline and diesel, which are suffering from bottlenecks.

The situation in the refinery sector also continues to be extremely tense. In April, refineries reported total processing of 78 million barrels of crude oil per day – the lowest output in more than a year.

The People’s Republic of China, in particular, has played a major role in this, as key parts of the country are once again under a strict covid lockdown regime. In the wake of this, not only has crude oil and distillate demand fallen in the Middle Kingdom, but national refinery output has also suffered from a labor shortage due to the prevailing situation on the ground, he said. Refining capacity in the U.S. also found itself underutilized in the month of April, according to a report from the Energy Information Administration.

Gasoline and diesel prices rise to new record highs in the U.S.

All these developments can be seen in the United States, for example, where gasoline and diesel prices have climbed to new record highs just before the start of this year’s main travel season.

Added to this is the fact that price ratios between the United States, Europe, and Latin America have recently shifted. As the Energy Information Administration reported in one of its latest weekly reports, exports of distillates such as gasoline and diesel have been well above their historical norm in recent weeks.

This could be one of the reasons why the entire U.S. East Coast is currently suffering from an immense shortage of diesel while prices are at record highs.

This week, ultra-low sulfur diesel inventories on the U.S. East Coast have fallen to near all-time record lows. Many analysts are predicting potentially further declines in inventories in this area.

Major freight and transportation companies warn of diesel supply drying up on U.S. East Coast

The U.S. East Coast has just over nineteen million barrels of ultra-low sulfur diesel in inventory, according to data released this week. Compared to the previous week, this results in a decline of just over one million barrels in this important distillate sector. Since the beginning of the year, stocks have plummeted by about half.

The fact that Ukraine, according to its own statements, interrupted part of the Russian Federation’s transit gas supplies to the rest of Europe in the current week led to a renewed price increase on the European gas markets in midweek.

As long as there are no signs of an easing of tensions in this conflict and all parties involved seem to have a vested interest in maintaining tensions and further fueling this conflict, the hitherto unseen situation in the international energy markets is unlikely to change.

Meanwhile, in the United States, this situation has led the largest trucking fleet operators in the eastern half of the country to prepare for an imminent diesel shortage, as logistics company Freight Waves reported on its own website.

Freight Waves founder and CEO Craig Fuller recently tweeted that three major trucking fleet operators were preparing for a complete dry-up of diesel stocks at America’s East Coast fueling stations.

Warnings had already gone out to drivers at these trucking fleet operations, including Loves and Pilot, with information regarding an impending shortage of gasoline and diesel supplies in the coming weeks in the eastern part of the country. This was followed by another tweet from Craig Fuller, from which evidence of this situation emerged.

Particularly in the Northeast and Mid-Atlantic regions, with reference to Craig Fuller, there could be a complete disruption of diesel supply very soon. One of the reasons for this could be that the U.S. is currently shipping large quantities of gasoline and diesel in the direction of Europe.

U.S. supplies Europe – and can’t afford it itself

The United States fed Europe through, so to speak, in view of the plans prevailing there to adopt an oil import embargo against the Russian Federation, which seems to be having a devastating effect on the domestic supply and supply situation with diesel, gasoline, and liquid gas.

From the point of view of many Americans, the question now arises as to whom US President Joe Biden and the White House will next hold responsible for this situation prevailing in their own country?!

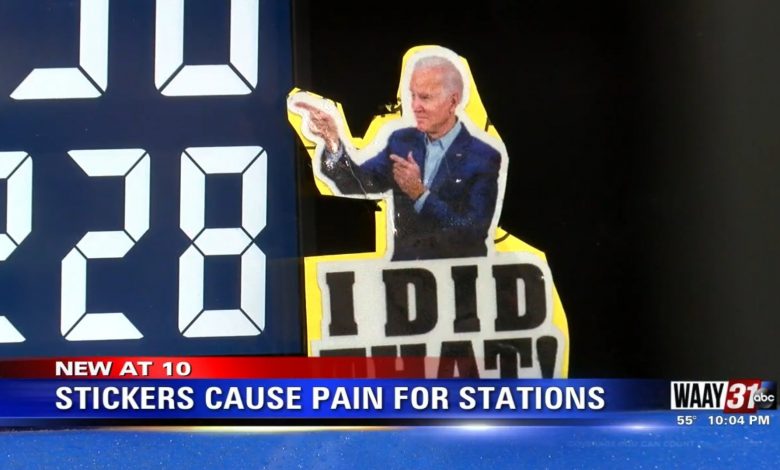

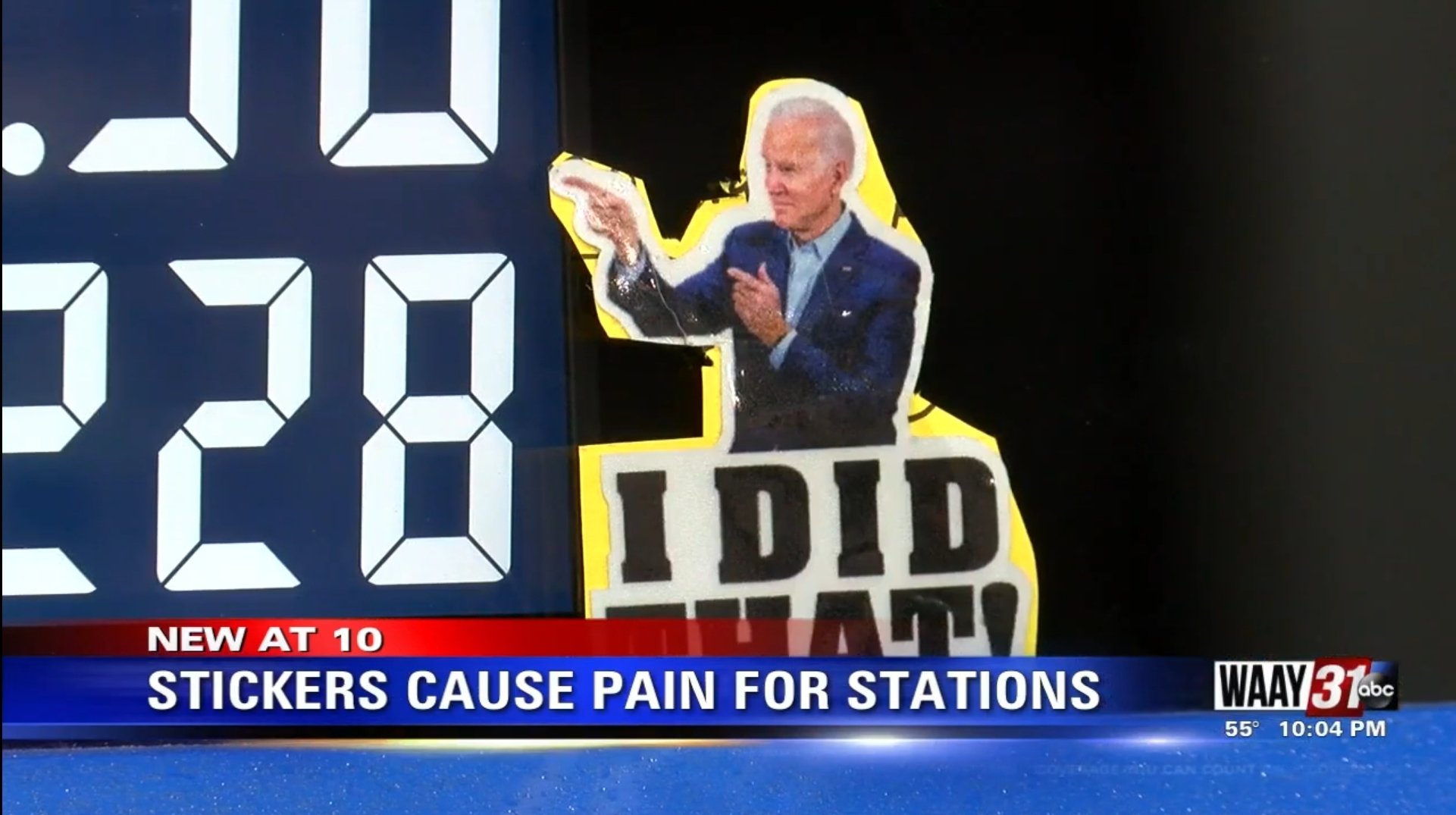

Slowly but surely, the number of scapegoat options is namely beginning to evaporate. Consequently, the number of stickers pasted on gas pumps nationwide, and stickers observed at gas stations that put the slogan ‘I Did That!’ in Joe Biden’s mouth, is growing immeasurably.

Returning to the International Energy Agency, it can be said that previous forecasts by the agency anticipated the onset of a global demand crunch due to persistently high energy prices.

The reality, however, is that the IEA has now adjusted its forecasts upward to indicate that global oil demand will increase by an additional 3.6 million barrels per day between the months of April and August.

Such a development would come at a time when the IEA is predicting that Russian Federation crude oil production will fall by three million barrels per day.

DepthTrade Outlook

Those who followed our very early recommendation to trade futures and CFDs on oil or invested in oil, gasoline, and diesel stocks, acted smartly.

The IEA added that, in addition to the production markets, companies and private consumers will also come under considerable additional pressure if the world’s refineries are not soon in a position to increase their supply of distillates.