Stock Market – How much Investors Money is still being held back?

Many believe that the stock market cannot fall at all. Why? There are no alternatives and too much money is waiting on the sidelines.

It is a misconception that the market can no longer fall.

Monetary policy or not, stocks can always fall, and that happens when buyers stay away. But why should buyers in this market stay away? Every small dip gets bought.

The market rises when buyers are willing to pay a higher price for shares. When the market rises, sellers hold on to their shares until the price has risen to the point where they find it attractive to sell. In other words, buyers’ demand exceeds sellers’ supply. Both sides only find balance when prices rise.

The opposite is true when prices fall. Many investors suddenly want to get rid of their shares. In order for them to find buyers, the price must fall. We last saw how quickly prices can fall in March 2020. An imbalance on one side of demand and supply can lead to strong distortions.

As long as there are buyers willing to pay a higher price, there is no need to worry about the market. But what does it depend on whether there are still buyers who will pay a higher price?

It depends on the level of investment. If you want to buy shares, you need money, and money that has not been invested by now. If an investor sells shares in Apple and buys shares of Microsoft for the money, no new capital has flowed into the market. One stock falls, the other rises.

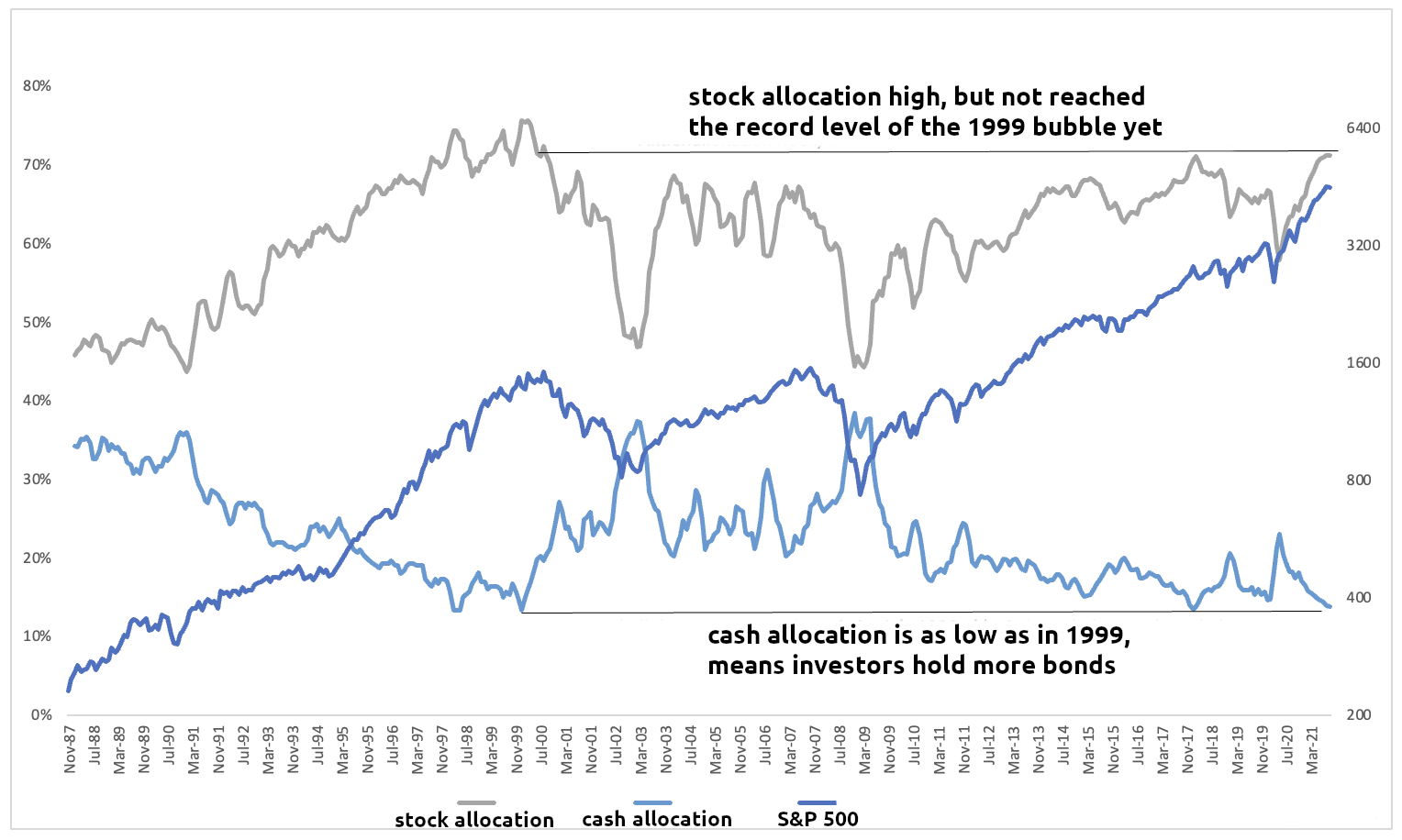

Very few investors are 100% invested in stocks. They keep some of their assets in stocks, some in bonds, and some in cash. Among U.S. retail investors, 71.2% are currently invested in stocks. Cash holdings are 13.7% (chart below). The remainder has been invested in bonds.

A stock allocation of 71% is high. It is the highest allocation since July 2000, when the Internet bubble just burst. The highest allocation was 77% a few months earlier. If we move towards a similar exuberance as in 2000, investors could well move fresh money from the sidelines (from cash and bonds) into the stock market.

Whether investors are willing to put more into stocks than they did in 2000 is questionable. Not every investor has 10 or 20 years left to ride out a crash. A lower stock allocation among older investors is normal and sensible.

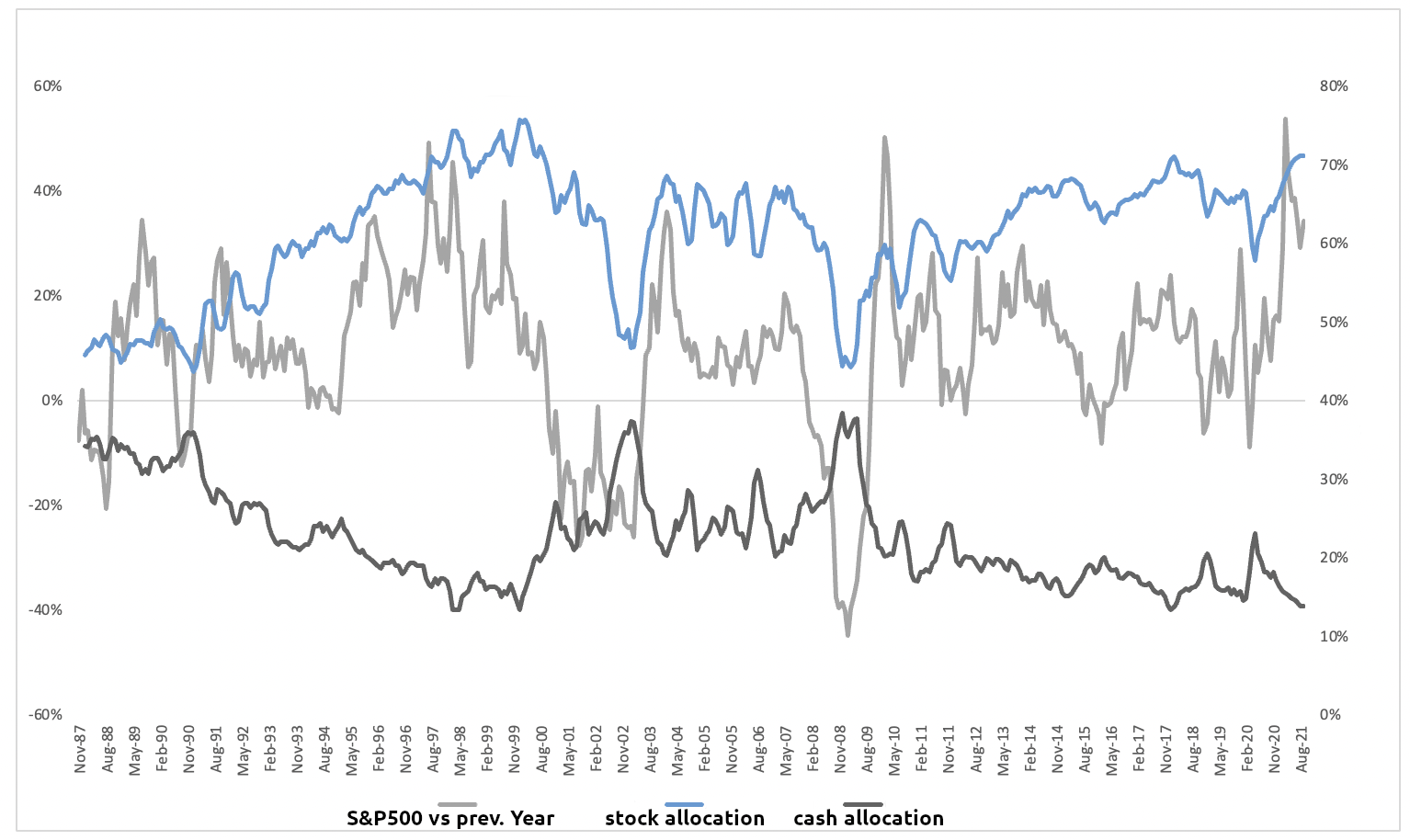

So the stock market is not running out of money yet. There is still fresh capital on the sidelines. That’s the good news. There’s bad news, too. The stock allocation is pro-cyclical. It is highest when the market hits a high and vice versa. The majority of private investors do not buy when prices are falling, but when they are rising (chart below).

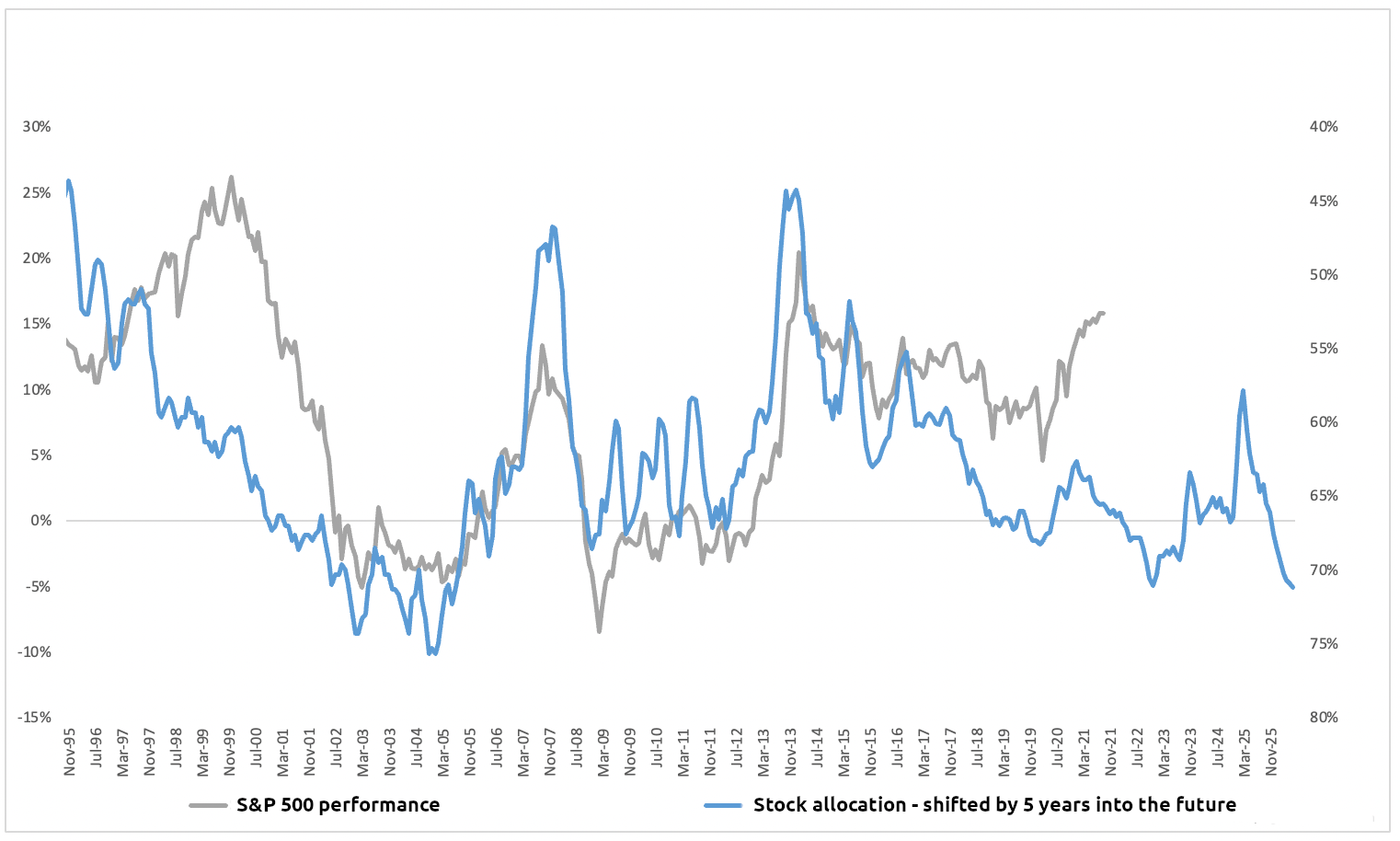

The allocation also says something about future performance. The more capital that has already been invested, the fewer buyers there will be to pay higher prices. If the allocation increases today, there will be a lack of buyers tomorrow. This becomes noticeable over a period of 5 years and more (chart below).

stock allocation and performance of the S&P 500 are strongly correlated. If the allocation is high today, the performance over the following years is lower.

DepthTrade Outlook

In theory, the yield on U.S. stocks should start to fall soon. However, the exact timing depends on how much the allocation still rises.