The Flow of Foreign Capital into the U.S. Stock Market

The U.S. stock market is by far the largest in the world. Total market capitalization is heading for $50 trillion. Foreign investors are also responsible for this volume.

US stocks are very popular around the world. Compared to many other regions such as Europe or Japan, the U.S. has enjoyed high economic growth for many years. A fast-growing economy is more attractive than stagnation in Japan or half of Europe.

For another reason, the U.S. is home to a handful of companies that have global influence like nothing else. Think of Facebook, Microsoft, Apple or Alphabet. If you want to profit from these global quasi-monopolies, you have to enter the U.S. market. There is no way around it.

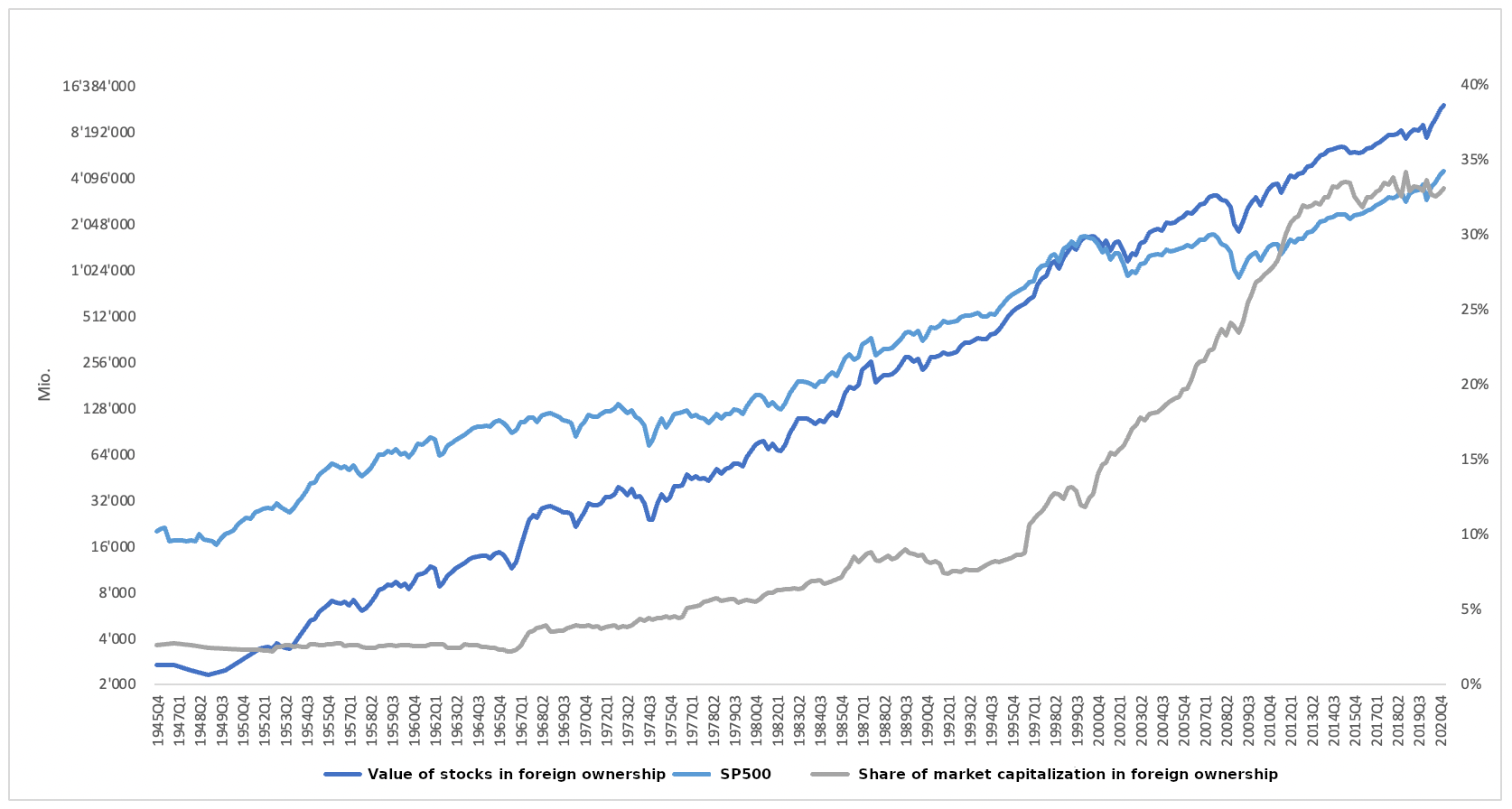

Hardly anyone in the U.S. is likely to complain about the influx of foreign capital. Without the high demand from abroad, the valuation would probably be different. In fact, one-third of the market is owned by foreign investors (chart below). This was not always the case. Until the 1960s, foreign investors owned less than 5% of the market.

The value of shares held abroad increased and decreased with the market. Since the late 1960s, the value of investments has risen faster than the market. This means that new money is always flowing into the U.S. and getting invested. Accordingly, foreign ownership has increased to one-third of the market.

In other countries, foreign investors own a respectable share of the stock market as well. This is also the case in Europe. However, the total market capitalization is smaller than the US market. It is easier to build up a larger share there.

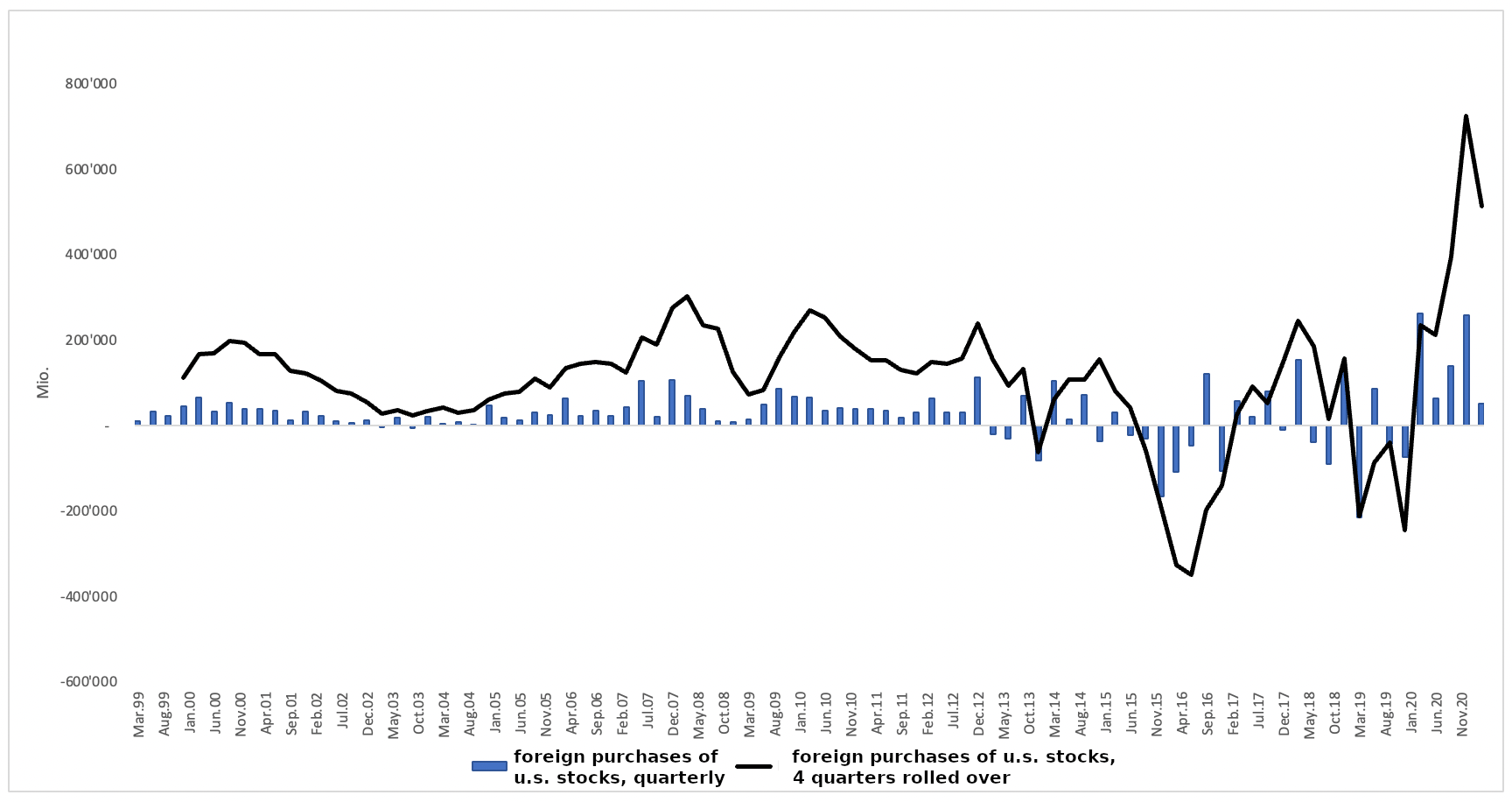

That makes what those foreign investors are doing in the U.S. market more important. In recent quarters, a lot of money has flowed into the US market (Chart below). In the first few months of the current year, the pace of capital inflows slowed noticeably. On an annual basis, the inflow has already fallen from over 700 billion to 500 billion. Interest is waning.

This can become a problem. It is no coincidence that the U.S. market performs poorly when foreign investors withdraw capital or invest moderately. This was the case in the past two bear markets as well as during the major corrections in 2015/16 and late 2018.

DepthTrade Outlook

Momentum is currently slowing noticeably. At the same time, the US market is not moving. If the flow of capital reverses, a prolonged period of underperformance must be expected. Considering the high valuation of the US market, this is quite conceivable.