UK and China: Energy Crisis ahead

It is no longer just the worsening situation surrounding the real estate giant Evergrande Group that is weighing on the development of the Chinese economy. Now, an energy crisis is also emerging in Asia, which would result in further supply shocks in a wide range of sectors. Regarding the Evergrande Group, it should be noted at this point that, taking current events into account, this is probably only the tip of the iceberg.

Fitch warns of far-reaching consequences of possible Evergrande collapse

As far as the Evergrande Group is concerned, it could well be the case that the major rating agencies determine a partial default of the Evergrande Group after the next twenty-five days have elapsed and for this reason, a “selective default” could be declared by Moody’s, S&P and Fitch.

Contrary to current speculation among a number of (optimistic) observers, who assume that the impact of a default would be limited to the People’s Republic of China, the rating agency Fitch warns that a potential collapse of the Evergrande Group would have more far-reaching consequences from the perspective of the rest of the world.

Semi-nationalization would only protect domestic investors

While interest-paying bonds among domestic bondholders were settled by the company last week, foreign bondholders literally looked down the barrel on Thursday last week.

This development has led financial markets to wonder whether the Beijing government might not be considering a “soft nationalization” of Evergrande Group in order to shield domestic bondholders and investors in so-called wealth management products (the country’s shadow banking sector) from financial turbulence, while foreign bondholders and investors could be left empty-handed.

An energy crisis is threatening Asia – it has already arrived in the U.K.

This problem is now being supplemented by an energy crisis also emerging on the Asian continent. Should there be a supply shock on the local energy markets in Asia, as is currently the case in the UK, such a development would leave regional economic activity far from unscathed.

Gasoline and diesel rationing occurred in the U.K. prior to the weekend, with many service stations in the country now subject to introduced tank-filling caps of 30 GBP per vehicle or customer.

According to the British government, there is sufficient gasoline and diesel in the country, but the necessary transport capacities from the refineries to the service stations are currently not available in sufficient quantities.

The result – as could hardly be expected otherwise – is that since Friday long lines have formed in front of the gas stations in Great Britain because panic buying has set in among private consumers.

Beijing wants to reduce electricity usage – industry affected

the Beijing government has significantly expanded its coal-based power generation since the beginning of the year, which now appears to be leading to consideration of how to curb and control CO2 and other gas emissions.

In this regard, a report from Bloomberg states that the Beijing government is currently intervening to reduce domestic electricity consumption, similar to many other areas of the domestic economy.

On the one hand, these interventions are being driven based on the sharp increase in gas and electricity prices, and on the other hand, due to the recent adoption of strict emission reduction targets by the Beijing government.

The country’s massively electricity-dependent industries, especially aluminum and steel producers, soybean factories and textile manufacturers are particularly affected by these interventions.

In the meantime, these industries have been called upon by the Beijing government to either significantly reduce their own electricity consumption by curbing their own activities or even to close factories and production plants entirely.

Has Evergrande overshadowed the massive problems in the energy market?

Commenting on these developments, Japanese investment bank Nomura says that Evergrande Group’s financial problems may have led to an underestimation of the energy market problems just emerging in the People’s Republic of China and on the Asian continent.

According to Nomura, a UK-style supply shock in Asian energy markets would result in the Chinese economy being at risk of falling victim to a contraction in the current quarter.

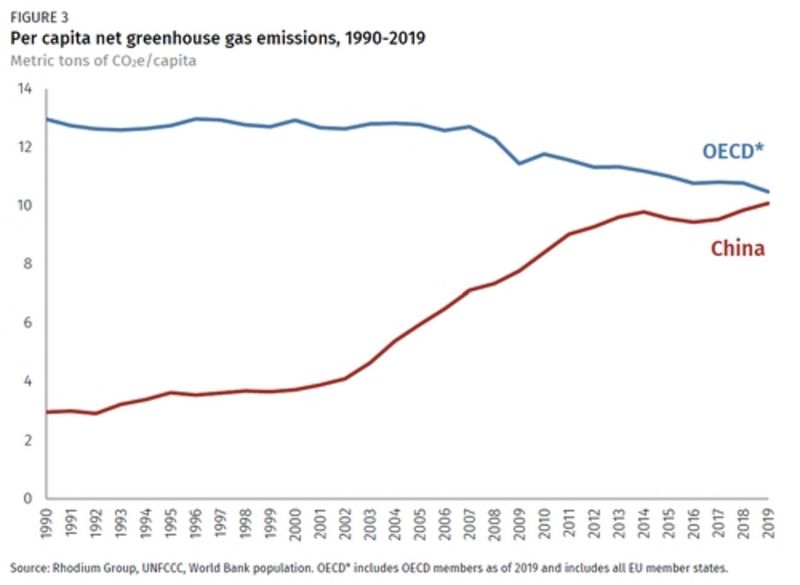

Despite the current interventions by the Beijing government, it should be pointed out once again that the People’s Republic of China is currently responsible for almost as high emissions as the United States and all other industrialized countries combined.

The People’s Republic of China recently declared its intention to significantly reduce its own emissions in the future in view of global reduction targets. However, it should be noted that emissions from coal combustion in China more than quadrupled between 2000 and 2020.

How can the demand for electricity be satisfied?

Last year, electricity production in the People’s Republic of China in the coal sector amounted to just under 4,600 terawatt-hours. From a current perspective, the question is how the Beijing government intends to live up to its lip service in the face of potentially rising gas and electricity demand over the course of the upcoming winter.

The Bloomberg report linked above quotes domestic energy experts who believe that the Beijing government will soon order energy producers not to increase their own electricity production, as has been the practice previously.

For the time being, it does not seem to be addressed in what way an increasing demand for electricity will be satisfied over the course of the next few months. The looming threat of a worsening energy and power shortage would be based on three important factors.

An energy crisis would result in further supply shocks

The primary factor is an already limited energy supply on a global level, which is already being felt in particular by the UK and the European continent. Furthermore, the global demand for energy among companies and private households following the lifting of lockdowns in many parts of the world exceeds the current supply of energy.

This is compounded by the fact that many oil, gas and mining producers are suffering from in part significantly declining investments, which will further restrict supply for the time being.

According to a report by Bloomberg, the current situation is rounded off by the fact that China’s President Xi Jinping is pursuing the political goal of reducing domestic emissions as much as possible before the Winter Olympics are held in the People’s Republic of China next year, in order to avoid the circulation of potential air pollution images in the media.

All these factors threatened to become a real threat, on the basis of which there could be a shortage of coal and gas production in the People’s Republic of China during the winter.

The result would be, as currently observed in the UK, a potential limitation and rationing of energy allocations to domestic companies and consumers. Nomura states that the risks arising from the current situation will have a serious impact on global markets and the global economy as a whole if the worst comes to the worst.

This is because, if the energy crisis worsens, it will not be long before there is a threat of further supply shocks in many other sectors of the economy, from textiles and clothing to toys, plastic products and machine parts.

If the Beijing government is indeed serious about its emission reduction targets to reduce domestic emissions to zero by 2060, such a development would result in more than six hundred coal-fired power plants in the People’s Republic of China falling victim.

DepthTrade Outlook

In the meantime, it is becoming clear what kind of dilemma the People’s Republic of China is facing economically. On the one hand, the power struggle for political dominance between the Beijing government and the domestic technology giants, above all corporations such as Alibaba, Tencent & Co. is intensifying.

If the state interventions in the technology and education sectors alone have not already caused a high degree of uncertainty among players in the financial markets, serious problems are also emerging in the real estate market, which when viewed in the light of day is nothing more than a giant Ponzi scheme, along with an unforeseeable future and viability of the project development giant Evergrande Group.

Since a possible collapse of the Evergrande Group had already led to an outbreak of social unrest in various provinces of the People’s Republic of China over the past few weeks, it remains to be seen how this might play out if there is an insufficient supply of electricity and other energy sources in the course of the upcoming winter.

If the Chinese economy were to contract again in the current quarter, as speculated by the Japanese investment bank Nomura, it is foreseeable that the Beijing government would not only fail to achieve its own growth targets, but that a possible recession in the People’s Republic of China – along with a financial crisis that might erupt around the Evergrande Grande – would also drag the entire global economy down with it.

It is advisable to keep a close eye on the developing situation in the global energy markets. In order to protect oneself against possible energy and power crises, one could consider purchasing a power generator and a stockpiling of diesel and gasoline supplies. Solar panels are also getting more efficient every year. It’s possible to hedge against further (possible) price increases in the energy markets with long positions on Oil and Gas or mining and energy stocks.