USA: Crypto Scene to Shell Out for Infrastructure Program

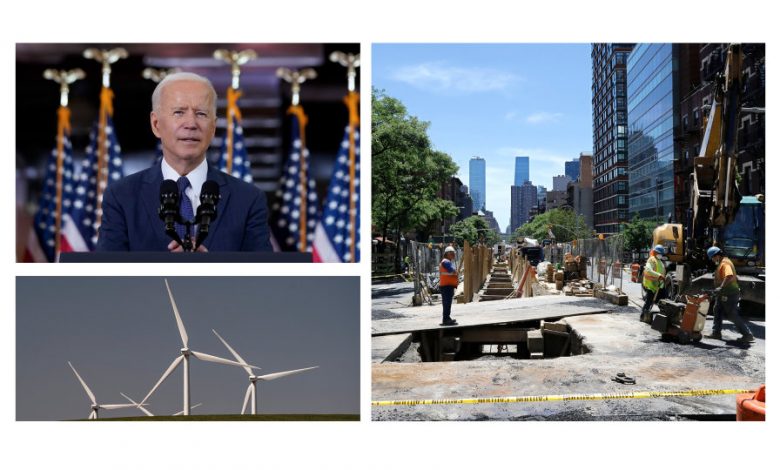

Investors in the cryptocurrency industry should not sweep current developments in Washington under the rug, as it is becoming apparent that the U.S. government intends to counter-fund the costs associated with the potential passage of a massive infrastructure program by taxing the cryptocurrency industry.

Tightening for cryptos is hidden in infrastructure program bill

For several years now, a significantly tightening regulation – or even a ban – of the emerging cryptocurrency industry has hovered over the heads of companies and investors in this sector.

That a significant tightening of this regulation in the United States would then be reflected in, of all things, that bill (and its numerous amendments) to enact a $550 billion infrastructure program proves to be a surprise after all.

Influential crypto lawyer Jake Chervinsky explains on his Twitter channel the ways in which the likely passage of this infrastructure program would impact companies in the cryptocurrency industry. The consequences, in Chervinsky’s view, would be devastating.

Jake Chervinsky’s warnings are derived in particular from statements in the relevant bill that outline the ways in which the construction and modernization of roads, highways, and bridges in the United States would be financed.

Taxation of “brokers” to contribute to financing

An amount of $28 billion is to be counter-financed, among other things, by taxing brokers in the cryptocurrency sector. Contrary to the previous assumption that this would only concern companies such as Robinhood or Coinbase, it is now dawning on investors in this area that anyone who is active in the investment universe of cryptocurrencies will find themselves affected by this.

Meaning, then, that under the definition of “broker” with reference to Jake Chervinsky, all economic actors in this field, including crypto miners and StartUp companies, will be included in potential taxation. Following passage of this bill, all actors in this report would likely see themselves required to report annually to the U.S. Internal Revenue Service (IRS).

Comparisons with the online casino sector

Countless critics point out that the cryptocurrency industry is now viewed by members of the U.S. Congress in much the same way as the once emerging online casino industry, which was hit with a hammer blow of regulation out of nowhere about ten years ago.

Comparable is also the fact that the cryptocurrency markets – similar to the online casino sector before – have a stigma of “sinfulness”, but beyond that the awareness among legislators prevails that with regard to the cryptocurrency markets it is an area that can be milked like a cow.

Unlike in the case of the Internet revolution, U.S. lawmakers seem to have no problem driving many companies in this emerging industry abroad. Another criticism among industry insiders is that the definition of taxes to be collected in the cryptocurrency sector is completely made up out of thin air – and thus arbitrary.

Too little lobbying in Washington?

Coinbase CEO Brian Armstrong has meanwhile called on all players in the cryptocurrency sector to contact their respective congressional representatives in order to ward off the threat of widespread surveillance of their own activities, including disclosure of all investment activities in the cryptocurrency sector.

At the moment, it does not give the impression that anyone in Washington is rushing to the aid of the crypto industry, which is now in the spotlight. Also a main reason for this might be that the cryptocurrency industry seems to have paid too little attention to lobbying activities in the capital Washington over the course of the past years.

Whether these efforts, which have now been made in response to the legislative plans in the U.S. Congress, will be crowned with success shortly before the deadline remains to be seen. For the first time, something like solidarity seems to be emerging among the various players in this area, in order to work together to persuade the legislators in Washington to make serious changes to their plans.

Hopes of joint success are fading with each passing day, however, as Democratic lawmakers have set their sights on passage of the infrastructure program bill in the current month of August.

One of the hopes is that the ultra-progressive wing in the Democratic Party, of which New York Congresswoman Alexandria Ocasio-Cortez is proving to be an icon, will take on its own demands and requests for changes in order to instrumentalize the concerns and needs of the cryptocurrency industry in terms of its own demands for even higher government spending – and thus make its own approval of the potential passage of the infrastructure program dependent on it.

At least something seems to have been done in this area before. Despite all this, Jake Chervinsky warns that the cryptocurrency industry is facing a storm including a wave of lawsuits to be filed specifically against the government.

Initiative of three Republican senators as last hope

For this reason, the initiative by Republican Senator Cynthia Lummis of Wyoming, Republican Senator Pat Toomey of Pennsylvania, and Democratic Senator Ron Wyden of Oregon to include an amendment that would exempt Bitcoin miners and some other players from potential taxation by the IRS seems to be perceived among leaders in the cryptocurrency industry as one of the last straws to clutch at now.

Finally, it should be noted that it had been apparent for several years that the cryptocurrency industry, not only in the United States but worldwide, would face a massive tightening of regulation.

The leading companies and associations in this sector have so far done little or nothing at all to counter this. From this perspective, the question arises as to whether it might not now be too late.

DepthTrade Outlook

In Turkey, cryptocurrencies are now banned, while the People’s Republic of China and other Asian nations such as Malaysia are cracking down on cryptocurrency mining in sometimes extreme ways.

That plans are afoot in other parts of the world, such as the U.S. and Europe, to skim profits from an emerging industry that is not only expected to fill soggy government coffers but also come with a shot across the bow of players in the field has been a long time coming.

As it turns out, cryptocurrency industry players are nevertheless anything but well prepared for these developments. Clearly, the focus has been on development processes, marketing, etc. over the course of the last few years. Beyond that, however, too little was invested in efficient lobbying. This now seems to be taking its revenge!