Wallstreetbets – Cinema Chain Hype: What is the AMC Stock Really Worth?

Because of Wallstreetbets and the hype – AMC can, within minutes, be worth 5 billion more or less. Clearly, investors disagree on value. But what should the value of the cinema chain really be?

AMC Entertainment’s current stock market value has little to do with the business itself.

AMC itself is aware of this. During the last share placement, it was explicitly pointed out that the recent stock price development has little to do with the core business. Likewise, they warned against a total loss when buying shares.

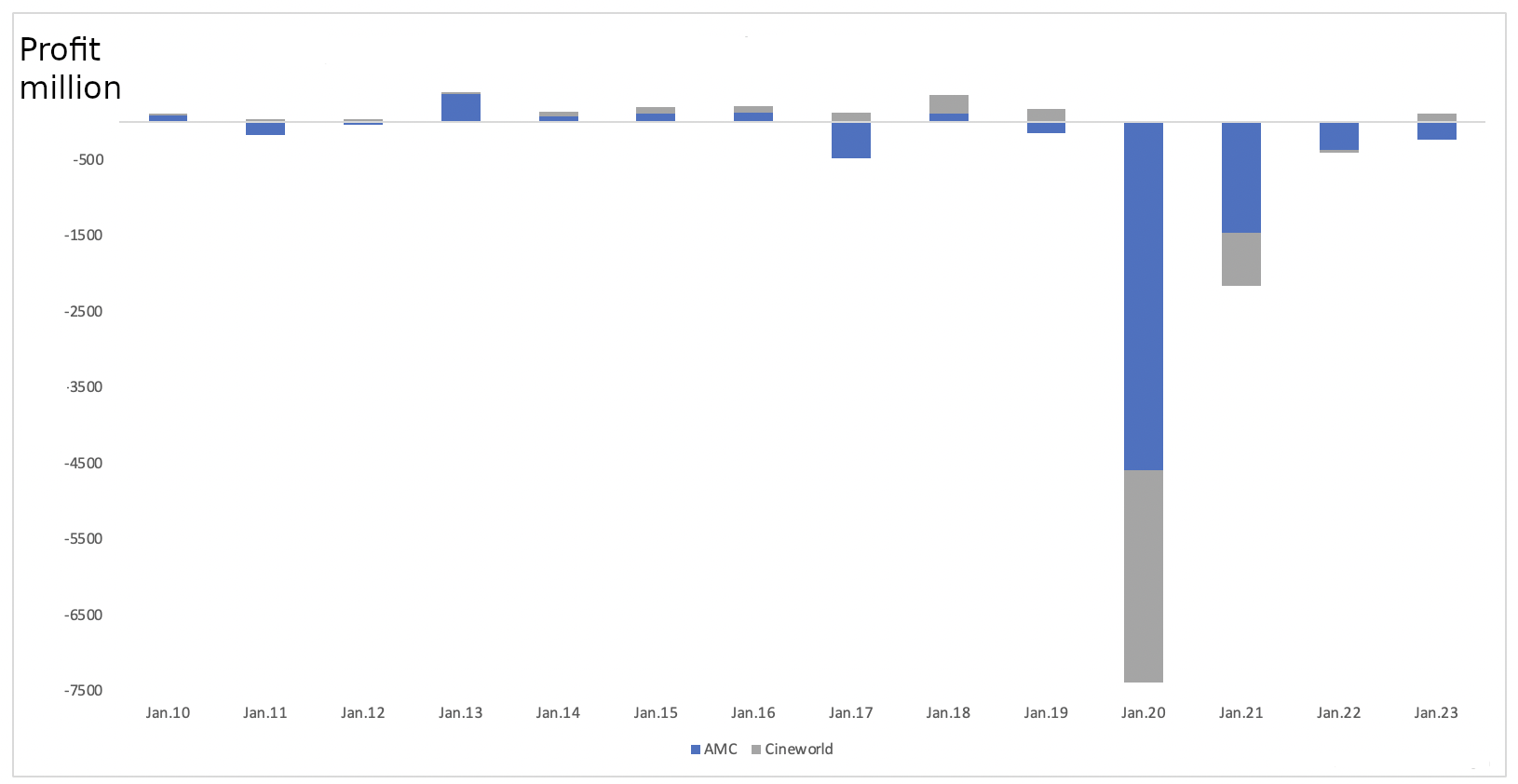

When a company itself warns of a total loss, that’s meaning something. AMC is apparently not sure itself that it is survivable. That’s not surprising. Debt stands at more than $10 billion. Revenue is not expected to reach pre-crisis levels until 2022 or 2023. Losses will continue to pile up until then (chart below).

This year, the company cannot make any profit from its core activity. That much is clear. It is not expected that cinemas will be open again in all countries until towards the end of the year. Moreover, half the calendar year is almost over and sales were scarce in the first four months.

For 2022, profits are not expected either.

The interest burden from debt alone is close to $700 million. Even in the best years, earnings before interest and taxes were far below that. AMC is simply not profitable and cannot be with this debt load.

Fundamentally, AMC is bankrupt and the price target is 0. Yet AMC is by far the most valuable movie theater chain (Chart below). This is true not only in terms of capitalization on its own, but also in terms of capitalization to revenue.

Thanks to hype, AMC was able to raise more than $1.2 billion in capital via the issuance of new shares. Management raved about using the money for expansion. 1.2 billion sounds like a lot of money at first. But this year alone is expected to produce a loss of 1.4 billion. Only the management knows how there will be money left over for expansion. In fact, the capital raised will just about ensure survival this year.

To use the money, needed for survival, for investments and takeovers is really bizarre. It’s like the captain of the Titanic, as the ship sinks, raving about the next voyage.

Still, the process is intriguing. With the high stock price, what if AMC issues another 50 million shares and raises several billion?

Other movie theater chains are worth comparatively little on the stock market. The second largest cinema chain in the world, Cineworld, is worth just over 2 billion. With a clever capital increase, AMC could take over Cineworld or simply finance the purchase 100% with its own shares.

Other cinema operators are only slightly more profitable than AMC. Cineworld and AMC together could very theoretically generate 600 million in profit per year. That’s the sum of the two companies’ previous record profit. But you have to add up AMC’s 2013 and Cineworld’s 2018 for that to happen.

DepthTrade Outlook

At a P/E ratio of 20 (the market average), the company could be worth 12 billion.

That equates to an AMC share price of 24 (assuming no more shares are issued). For that price, however, you have to turn so many blind eyes and ignore facts that it’s frivolous.

Assuming AMC survives at all in the long term (a legitimate question given the trend toward streaming), a capitalization of 4 billion or a price of 8 dollars is conceivable. That’s where the share price will return to, or lower. We just don’t know when that will be.