Warning: US Yields Sliding

This scenario of falling US yields is hardly on anyone’s radar. Stocks of the U.S. banking sector began to slide downwards.

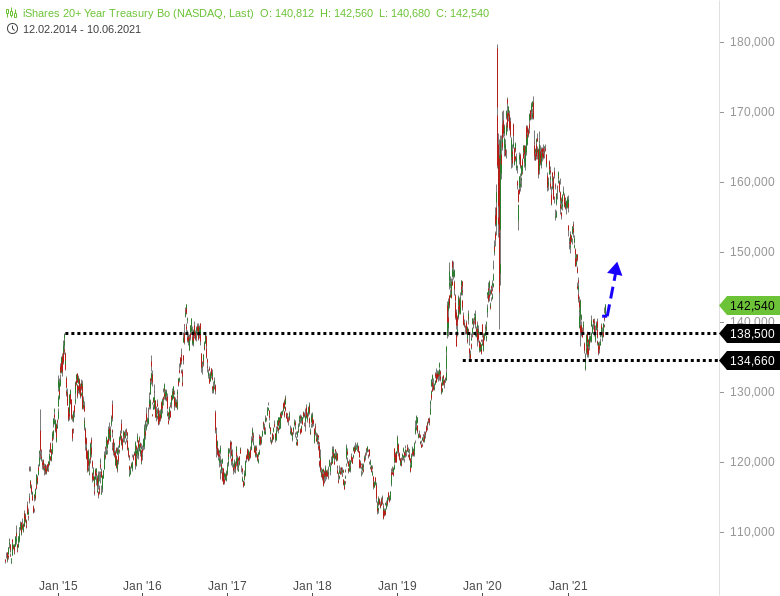

The TLT is the major US government bond ETF.

A rising TLT, means falling US yields. A falling TLT, means rising US yields.

At USD 138.50, there is a long-term relevant, inner support line in the market. Since the end of February, the price has been swinging in the area of this support. A chart-technical bottom has formed, from which the price today begins to break out dynamically in line with the rules to the upside. A short- to medium-term rise of the TLT towards USD 148-150 is expected. Thus, a short- to medium-term rise in U.S. Treasuries. Vice versa, a short to medium term slide in US yields is expected. I am curious. Hardly anyone has this scenario on the radar.

The rise in Treasuries/bonds had direct implications in the US equity market today. Stocks of the U.S. banking sector began to move downward.