Will rising Wages really Pressure the Stock Market?

Labor shortages are currently a global phenomenon. Wages are rising accordingly, not only because of inflation adjustments. Conversely, this increases costs for companies. Is this situation turning into a problem for the market?

Employees have not been in as good a position as they are today for decades. Despite low unemployment in the USA and many European countries, wages hardly rose at all. Employees did not participate properly in the upswing. In some countries, real wages even continued to fall.

This has come to an end since the start of the pandemic. Wages are rising faster than they have in decades. This is true even after deducting inflation. The reason for this is a discrepancy between the demand for and supply of labor. Companies are desperately looking for employees, but candidates are reluctant to offer their labor.

The extent of this discrepancy varies from country to country. It is particularly pronounced in the USA. Many households were able to save a lot during the first 18 months of the pandemic, not least because of cash gifts from the government. Currently, there is limited pressure to find a job right away.

At the same time, many job openings are not attractive. Many are no longer willing to work three jobs at minimum wages just to survive. Companies have to offer more. To a certain extent, they had to do so even before the crisis. The crisis has merely accelerated the trend.

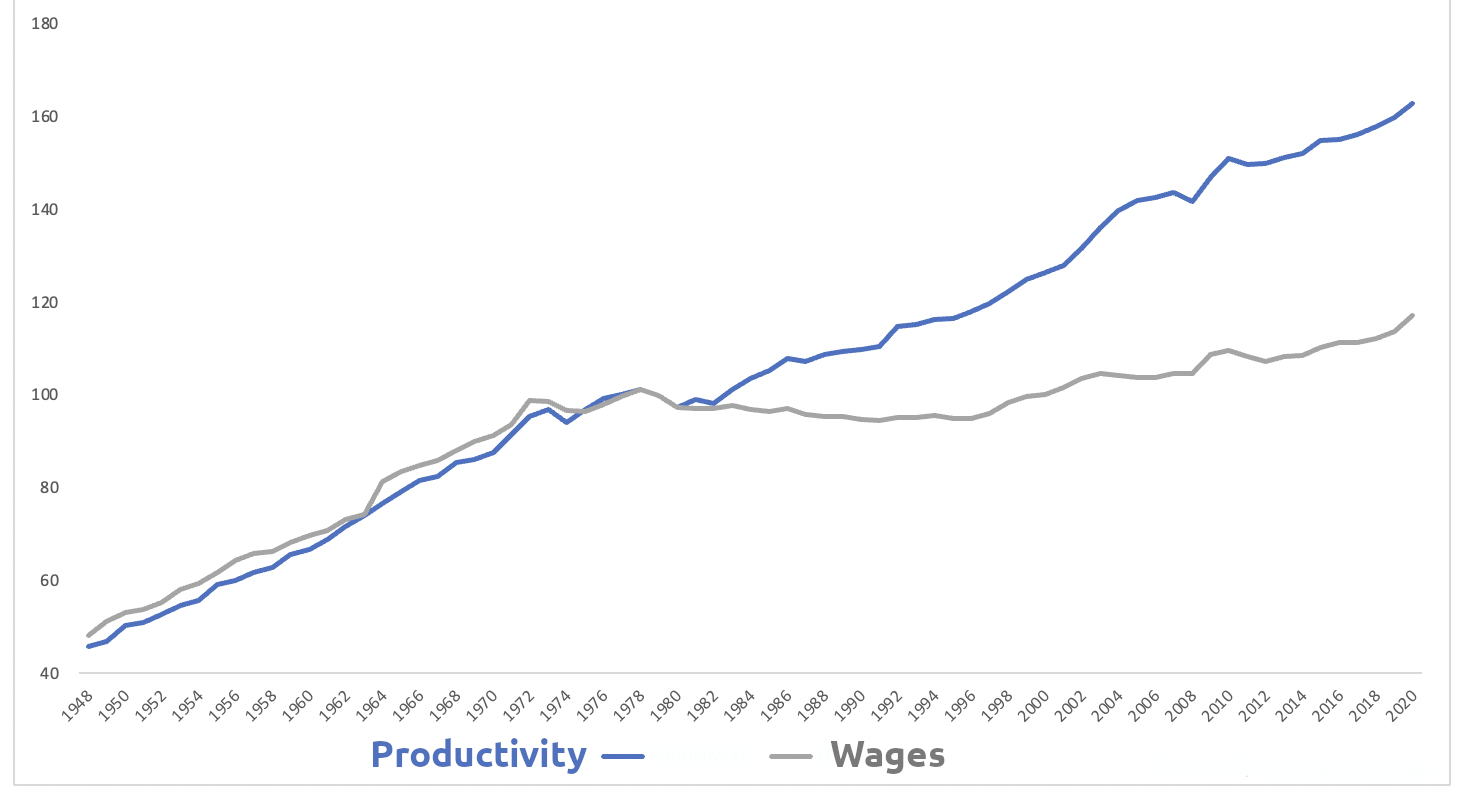

This ends a trend that began in the 1970s. Productivity has been rising since the 1970s. However, real wages have not been able to keep pace (chart 1). Workers benefited little from the fact that it was possible to produce more with the same amount of resources.

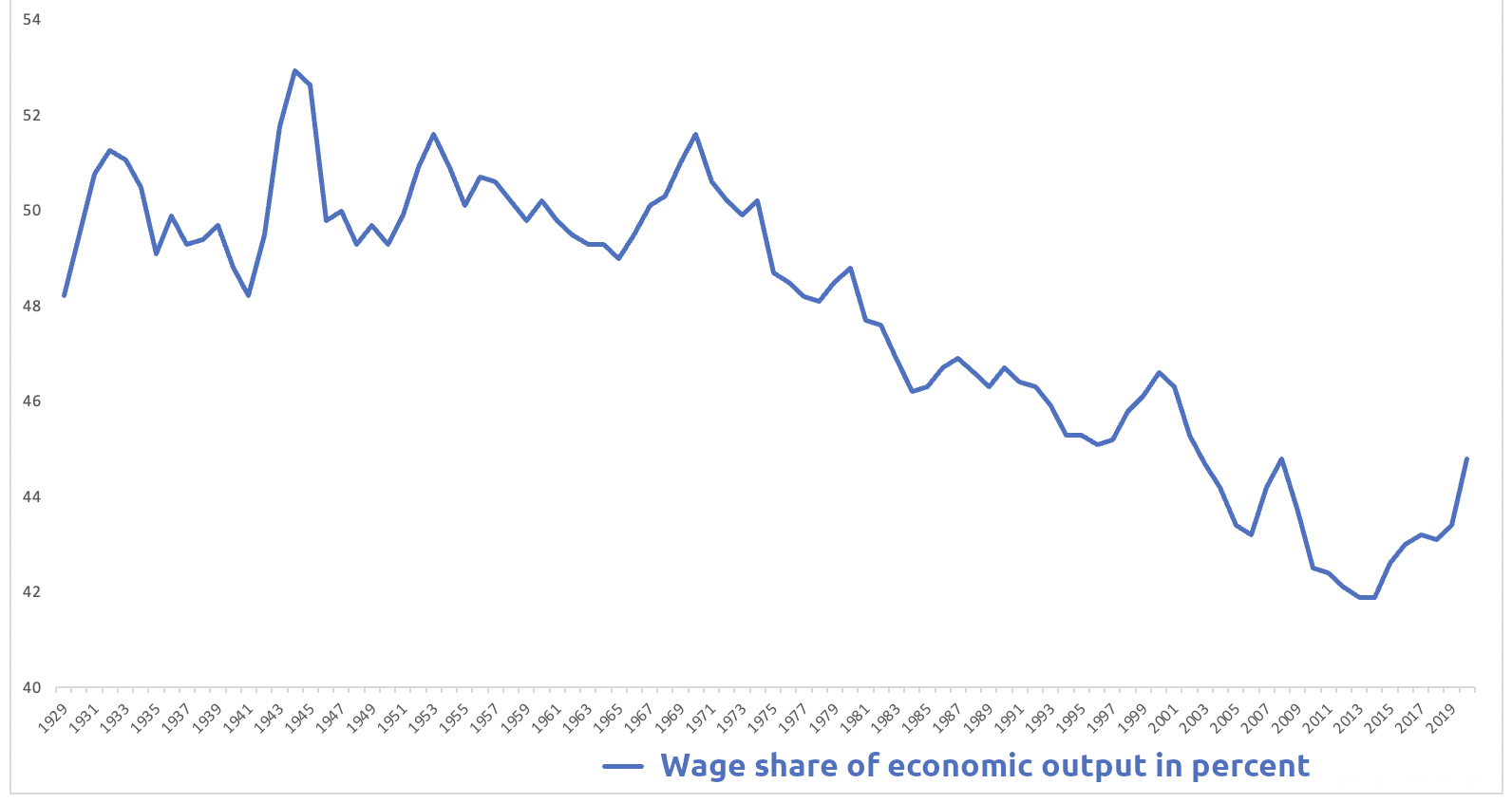

The share of wages in economic output fell accordingly (chart 2). The wage share was stable, with certain fluctuations, until the 1970s. It then fell continuously until 2013, since when there have been signs of a change in trend.

There are multiple reasons for this. The policies that began in the 1970s favoring corporations over workers are coming to an end. All over the world, election results testify to the need for a change in policy. The trend has begun, but it is far from over.

This inevitably raises the question of whether the stock market will thus have to be valued differently in the future. If the wage share rises, it reduces companies’ margins. Lower margins mean that profits grow more slowly, and profits are what determine prices in the long term.

The valuation, measured by the price/earnings ratio, should therefore actually fall in the event of a change in trend. That would only be logical and consistent. However, there is good news for investors. Historically, there is no reliable correlation. Valuations have risen and fallen completely independently of the wage share in economic output (chart 3).

The conclusion is thus not very clear. Valuations may fall, but they do not have to. This is at least a better conclusion for investors than a necessarily lower valuation if the wage share rises.