Bitcoin and Stagflation – Analysis & Outlook

The specter of stagflation is haunting. Not since the 1980s has the threat of inflation accompanied by economic stagnation been as real as it is these days. How Bitcoin and Co. might behave in such a phase and why one particular circumstance holds hope for the crypto sector.

The continuing supply chain problems and the war in Ukraine have triggered panic on the commodity markets. Prices for fossil fuels, industrial metals, and agricultural raw materials are reaching unimagined highs. The consequence: Everything is getting more expensive. Bread, the staple food of many regions, is becoming more expensive not only because of the rise in energy prices but also because the price of wheat is simply skyrocketing.

At the same time, employees and unions are putting pressure on salaries – for understandable reasons. The momentum of the dreaded wage-price spiral could take full effect in the next few weeks/months. For example, the average inflation of 5.8 percent in the eurozone could soon catch up with the EU leaders Lithuania, Latvia, and the Czech Republic. There, purchase price inflation is already over 10 percent.

Should growth now also fail to materialize, the specter of stagflation would threaten our prosperity. Rising inflation would then no longer be sufficiently compensated by growth. The majority of investors would lose money and simply become poorer. Most public companies lose value in times of stagflation. But what about cryptocurrencies, especially Bitcoin, in a stagflation?

Stagflation: Zero empirical values for Bitcoin

Nobody is able to predict the inflation rate. Neither the European Central Bank, nor investment banks, nor financial analysts on YouTube. Very well, however, the probability for certain scenarios is increasing. One such scenario is the now much-discussed stagflation. The difficulty: since the cryptocurrency asset class has existed, there has been no stagflation in the major industrialized nations. So there is a lack of empirical data for the asset class, which is difficult to value anyway.

Accordingly, it can make sense to orient oneself on the reaction of technology or risk assets. After all, these have shown the highest correlation to cryptocurrencies so far. Like the growth stocks in an ARK Innovation ETF, most cryptocurrencies have fallen 50 percent or more in some cases since their correction began last November.

The big problem of inflation

Viewed in isolation, higher inflation is not bad for either tech stocks or Bitcoin per se. However, as inflation increases, so does the likelihood of central banks raising interest rates. The result is a less expansionary monetary policy and that, in turn, is very much bad for bitcoin and tech stocks and good for US dollars as well as government bonds. As a result of the U.S. Federal Reserve’s change in policy, the aforementioned innovation stocks are therefore under severe pressure. Finally, financing costs for growth are rising and opportunity costs are increasing.

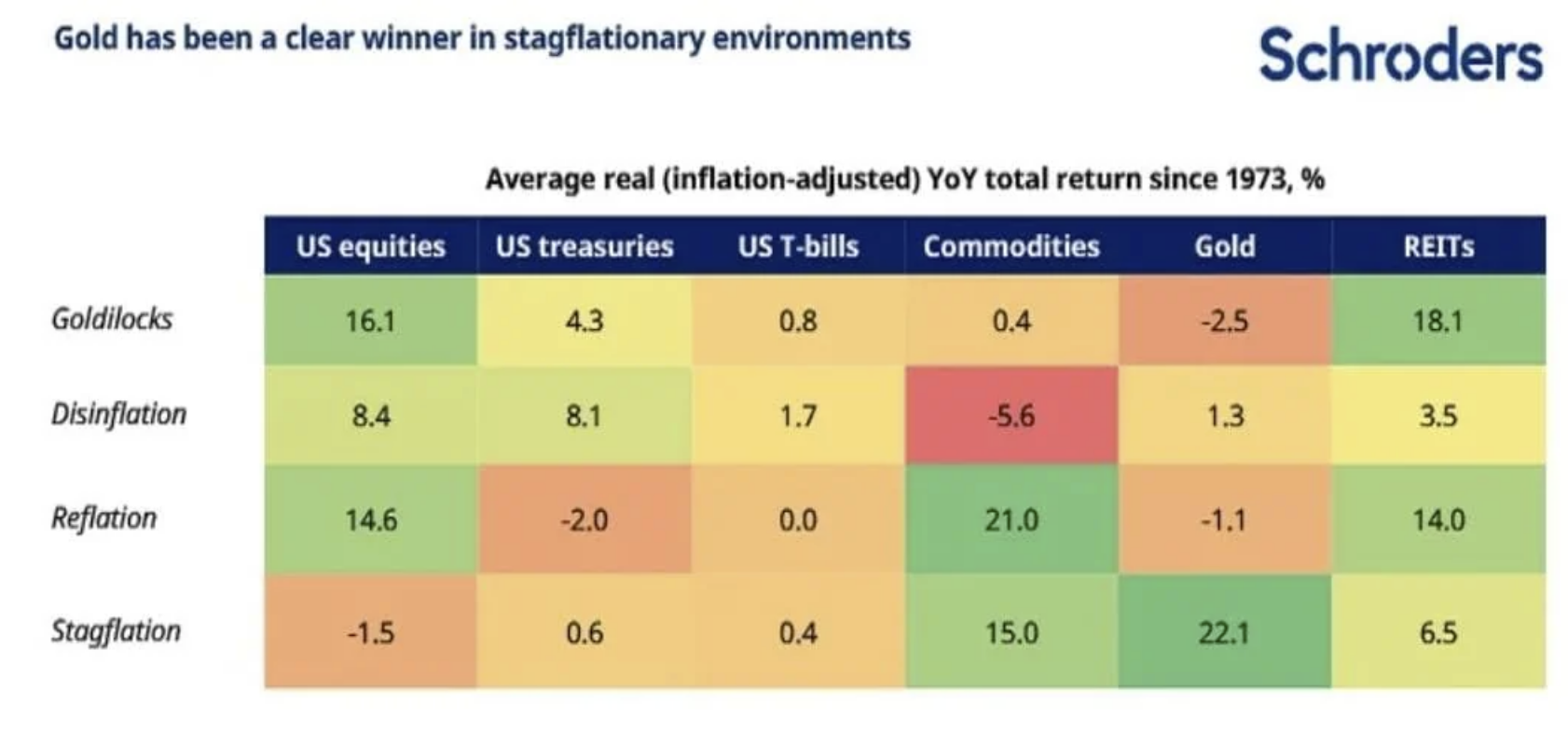

If the corresponding growth fails to materialize, ergo inflation turns into stagflation, the current development could even intensify. Historically, gold and commodities are the only investments that have performed strongly in stagflation in the past (see chart below). They were followed by real estate, which also gained, while stocks lost value on average. Transferring this logic to cryptocurrencies, things look anything but good for the asset class during stagflation.

Bitcoin no digital gold for the time being

There is still hope, however. For example, the market has not yet embraced the narrative that Bitcoin is the new digital gold. While some crypto asset managers may write that on their promotional flyers, and Bitcoin supporters may also support the digital gold narrative 100 percent, the reality is different. When it came to market panic, such as currently caused by the Ukraine war, gold, not Bitcoin, was the asset of the hour. Neither as a short-term inflation hedge nor as a safe haven could Bitcoin convince in the past.

The chance that Bitcoin will be perceived differently among investors in the future, respectively that its correlation to risk assets will change and also effectively become digital gold, could have a positive effect on the No. 1 cryptocurrency. Unfortunately, the conclusion that the digital gas of the Ethereum Blockchain now also correlates with the physical gas price is too far-fetched. After all, there is a supply shock in physical energy sources. On the supply of Ether and Co. on the other hand, the Ukraine war has no impact at all. It is more likely that altcoins are valued by the market like startups or young growth companies and consequently come under pressure in a stagflation.

Growth despite stagflation

Just because growth fails to materialize and inflation is high does not mean that every company or even every cryptocurrency has to lose value. Rather, such phases are to be understood as trend statements. This means that it is possible to make a lot of money with stocks on the long side. In contrast to the last few years, however, you have to bet on the right candidates. Stock picking instead of ETF acquisition would be the conclusion.

Even in the most difficult market phases, there are companies that can increase their profits and expand their market share. Growth can therefore also occur in a period of stagflation, but then it is more likely to be found at the individual or micro rather than macro level. But what does this logic mean for the cryptocurrency market?

Crypto Market: Is the Great Decoupling on its Way?

The biggest opportunity for the crypto market is that so-called mainstream adoption increases to such an extent that the negative market environment is overcompensated. The crypto sector would then decouple from technology and growth stocks. A glance at the S&P 500 would then no longer be sufficient to know whether the signs on the crypto market are green or red.

Decoupling through growth during a period of stagnation would certainly be a wishful scenario, as it would mean massive strength and relative undervaluation to other asset classes. However, the still recent past from the crypto sector has shown that extreme jumps are possible in a very short time. Especially if the biggest burdening factor for cryptocurrency prices, namely regulation, should develop positively, this could mean capital inflows that make a weak market environment fade into the background.

DepthTrade Outlook

Conclusion on Stagflation and Bitcoin

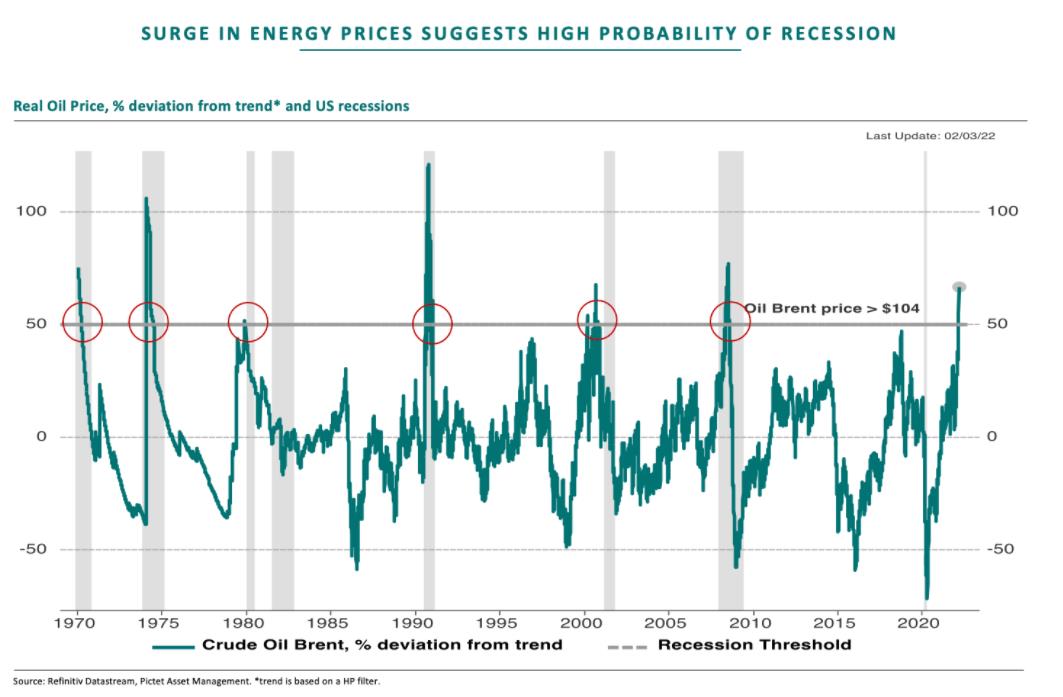

The well-known stagflations starting in 1972 up to and including 1982 in the industrialized countries were each caused by an oil price crisis. For 40 years now, we have not been as close to an energy crisis as we are now. In view of the inflation rate and the sharp rise in oil and gas prices, it would seem logical to fear stagflation and an economic slump. After all, every oil price increase of more than 50 percent in the last 50 years has led to a subsequent recession within a short period of time (see chart below). However, the stable unemployment rate and so far solid situation among companies still argue against stagflation at present.

In the short term, the negative effects on Bitcoin and the crypto market may outweigh them. It is unlikely that Bitcoin will be perceived as digital gold by the market after all. Russian oligarchs with monetary flight instincts aside. A further escalation of the Ukraine war and a possible oil embargo could push the financial markets even further down. Those trading now will have to deal with maximum volatility in both directions.

Such real economic factors could therefore also have an impact on the financial economy for the time being and prevent rallies. Fundamentally, the Ukraine war and the threat of stagflation have not changed the prospects of Bitcoin and Co. Therefore, those who are convinced of the success of the aforementioned assets can use such market phases to buy up.