Crypto Ban – Why China still dominates the Crypto Mining Industry

China has always been an important market for Bitcoin and other cryptocurrencies, but that has changed in the meantime – what is the current situation?

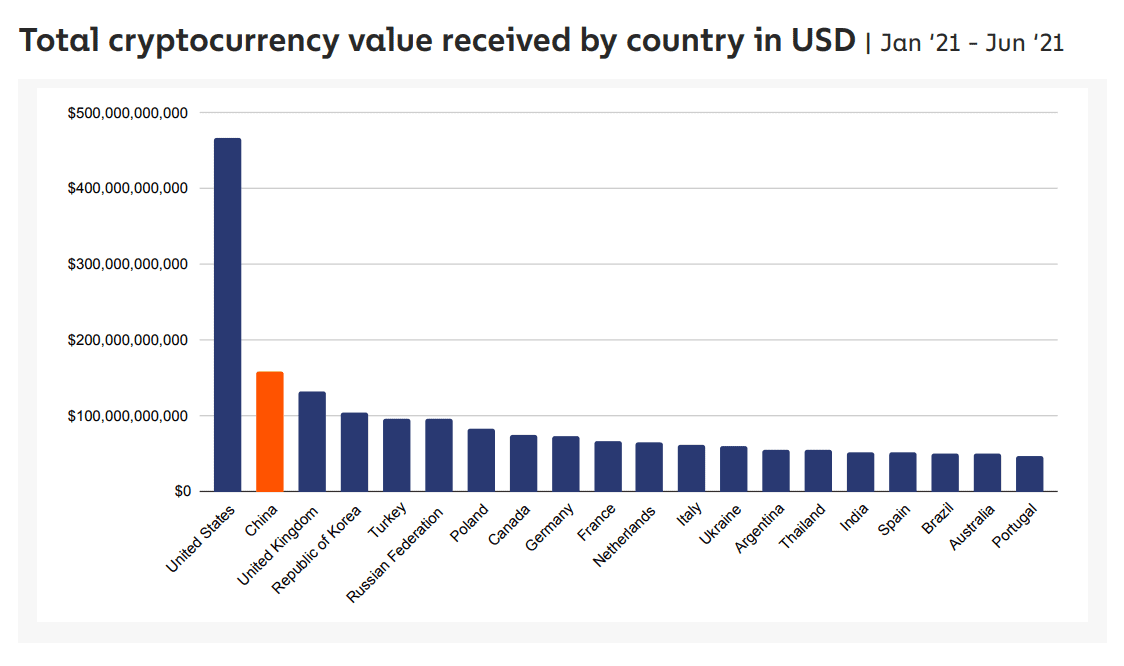

Bitcoin and crypto have been an integral part of China for a long time. The Chinese crypto community was one of the most active in the world. Despite the increasingly restrictive measures of the Chinese government (CPC), China has the second largest market for cryptocurrencies after the USA.

Data from crypto analytics firm Chainalysis shows that between January and July 2021 alone, cryptocurrencies worth over $150 billion have flown into China.

In addition, China has also dominated the Bitcoin mining industry in particular in the past. At times, it is estimated that the Middle Kingdom was even responsible for around 65 percent of the global Bitcoin hash rate.

However, China is increasingly losing its status as a crypto superpower. And that’s because the Chinese government is cracking down harder and harder on cryptocurrency trading and the mining industry.

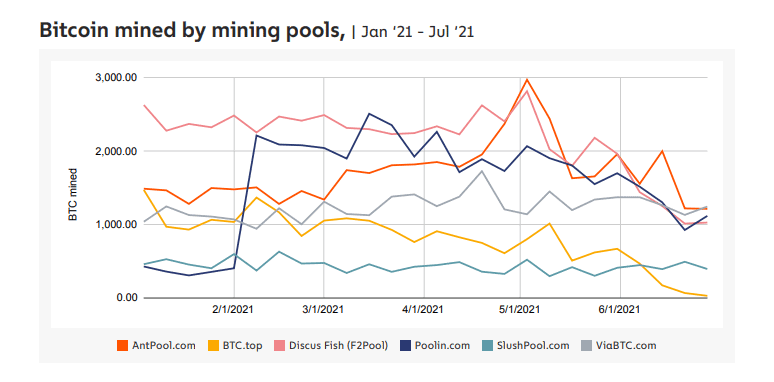

In May 2021, government officials announced their intention to crack down on mining and trading of cryptocurrencies. Shortly after, the global hashrate dropped as many Chinese miners shut down operations. Poolin, AntPool, F2Pool, BTC.top, and ViaBTC are all mining pools that have been primarily based in China and caused a sharp drop in the Bitcoin hash rate in the wake of the May 2021 Bitcoin mining ban.

The chart above illustrates how the hash rate of all Chinese mining pools has decreased after the mining ban. At the same time, you can see that the Czech mining pool SlushPool has not seen a decrease in hash rate over the same period.

Why Chinese companies still dominate crypto mining

After the ban, many Chinese crypto miners moved to other countries. Most popular among miners were the United States, South America, Iran, and Kazakhstan. As a result, a massive redistribution of the hash rate took place on a global level and one can assume that sooner or later the last Bitcoin miner will leave China.

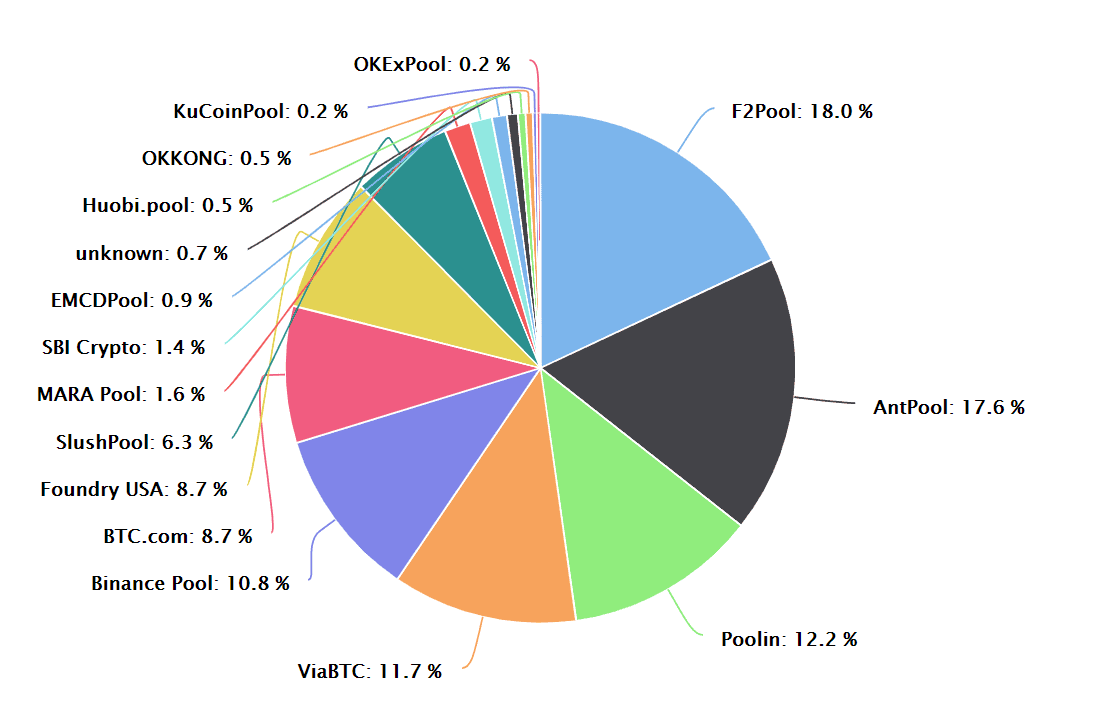

However, if you look at the current hash rate distribution, you can see that Chinese mining pools are now back at the top.

So it seems that an overwhelming majority of Chinese miners have managed to transfer their mining equipment to other countries. The top three Bitcoin miners are again Chinese companies that have set up their farms in other countries.

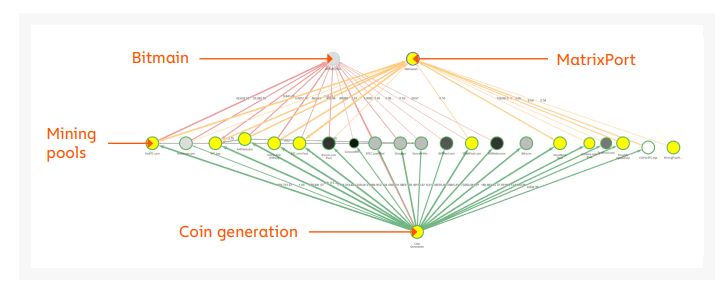

In addition, China continues to dominate the mining equipment market. Much of the mining hardware is manufactured by the Chinese company Bitmain. Bitmain also owns AntPool, currently the second largest mining pool in the world. Furthermore, an analysis by Chainalysis shows how important Bitmain still is for the mining industry.

The chart shows Bitmain’s on-chain transactions with some of the largest mining pools. Green arrows represent newly mined Bitcoin that mining pools are taking. Red lines represent mining pools sending bitcoin directly to Bitmain to buy mining hardware. In addition to Bitmain, you can also see a wallet for a company called MatrixPort. According to Chainalysis, MatrixPort is a cryptocurrency payment service provider that has been processing payments flowing to Bitmain since 2019. These payment flows are shown in the graph with orange lines. They show that the same mining pools still buy the bulk of their mining equipment from Bitmain – a sign that Chinese companies still dominate the mining sector.

DepthTrade Outlook

The Chinese government has pretty much driven all miners out of China and massively restricted cryptocurrency trading. Meanwhile, the Chinese government is also cracking down harder and harder on crypto trading. Nevertheless, Chinese mining pools dominate by far the largest part of the Bitcoin hash rate and at the same time most miners still rely on Chinese mining hardware.

On the one hand, the Middle Kingdom promotes blockchain innovation in its own country. On the other hand, the Chinese government is cracking down on the crypto space with bans and trading restrictions.

Many signs suggest that the CPC has realized the power of cryptocurrencies and blockchain technology. The CPC may now want to ensure that it controls the use of this power as much as possible and therefore continue to restrict the crypto market. Bobby Lee, a crypto veteran, already revealed in an interview in July on Bloomberg that he could even imagine China banning cryptocurrency trading completely sooner or later. This forecast has now been confirmed by the latest news from the Middle Kingdom. DepthTrade already warned about the Situation in June.

This, in turn, could be because the Chinese government wants to push its own digital currency. Why the Chinese government has gone after its mining companies, but not directly, could be because China wants to continue undermining the U.S. sanctions regime. This circumstance could also explain why so many mining companies have entered into partnerships with Iranian companies.