Why Prices Keep Rising?

For years now, crash prophets have been warning of excessively high valuations for stocks and real estate. But prices continue to rise. There is a simple reason for this.

Everything is getting more and more expensive: While consumer prices are only now really getting going, prices for assets such as stocks and real estate have simply been rising for years. There has never been a shortage of worrywarts and crash prophets. Time and again, famous investors, most recently Michael Burry and Jeremy Grantham, have warned of excessively high valuations and an imminent crash on the stock markets.

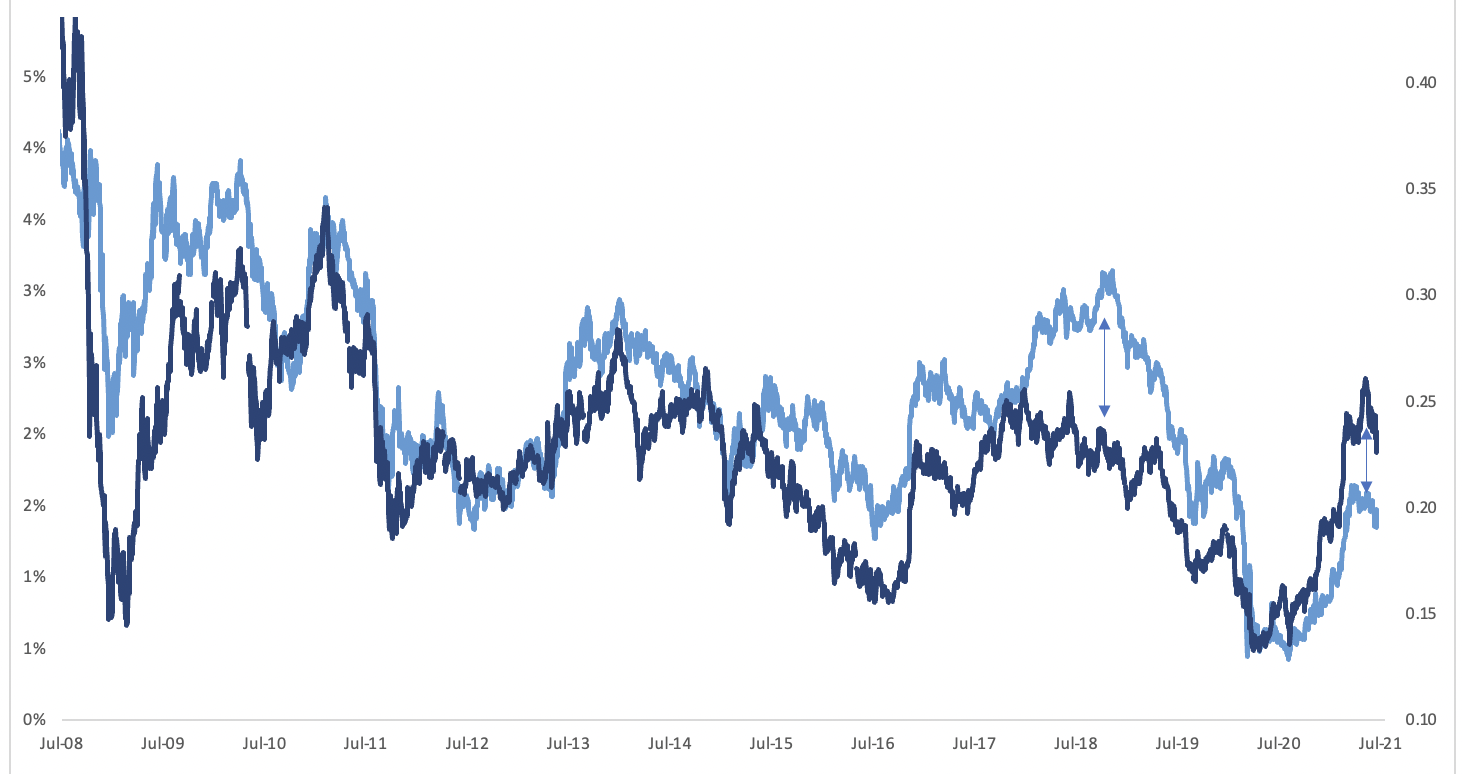

We hear very similar things on the european real estate market: For years, experts have been warning that fewer and fewer people are able to afford real estate at all and that purchase prices have risen more sharply than rents. The so-called rental yield (annual rent divided by property price) is now so low in many places that buying is becoming less and less worthwhile.

But the market doesn’t seem to care much about these warnings. Stock prices rise seemingly ad infinitum. Real estate prices continue to rise, even though most of the population will never be able to afford the dream of owning their own home.

The sharp rise in prices and valuations may seem irrational, but it is in fact only a consequence of the fact that the money supply has also virtually exploded. In the eurozone countries, the M1 money supply has grown at an annual rate of 7.98 percent since 1980. In the long term, this should also roughly correspond to the return on the stock and real estate markets. The same can also be observed in america.

The situation is very similar on the real estate markets: Here, too, the long-term return is likely to be at most marginally higher than the growth of the money supply, at least on average. The sharp rise in stock prices and real estate prices is therefore, at least to a large extent, merely an optical illusion: Relative to the exploding money supply, prices have risen marginally at the most.

DepthTrade Outlook

The perpetual growth of the money supply expropriates the vast majority of the population in real terms in the long run, even though nominal wealth may increase. Only those who own the bulk of their assets in the form of shares and real estate can retain or even increase their wealth in the long term. Those who do not increase their assets by eight percent annually (which very few people are likely to succeed in doing) will actually become poorer instead of wealthier.

In view of this fact, it would be urgently necessary to promote the accumulation of assets by broad sections of the population much more strongly in political terms than has been the case to date. Unfortunately, few politicians seem to have recognized this.